KTFA Sunday CC: “!FRANK26…..5-19-24….PRAY FOR IRAN”

KTFA

Sunday Conference Call

!FRANK26…..5-19-24….PRAY FOR IRAN

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Sunday Conference Call

!FRANK26…..5-19-24….PRAY FOR IRAN

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Clare: Watch...the first shots of rescue teams heading to the site of the Iranian president's helicopter crash

5/19/2024

Iranian TV: Bad weather conditions in the west of the country hinder relief teams from reaching the Iranian president's helicopter

Iranian TV: The helicopter carrying the country's president has not yet been found and there is no detailed information about the accident

Iranian Emergency Authority: Sending Red Crescent rescue teams and marches to the site of the accident

Iranian Emergency Authority: We have not yet received any reports of the Iranian President’s helicopter crashing

Iranian Interior Minister: Rescue teams have not yet arrived at the scene of the accident, due to bad weather and fog. The president’s plane made a difficult landing.

Iranian Minister of Interior: We do not yet have information about the condition of the Iranian President due to weather conditions and the difficulty of reaching him.

The government IRNA agency: The Iranian president’s plane crashed in the “Dezmar Forest” in the general area between Farazgan and Julfa in East Azerbaijan province.

-It is not possible to communicate with the helicopter crew due to bad weather conditions.

Iranian Red Crescent: We sent a helicopter and rescue teams from 4 provinces, namely West Azerbaijan, East Azerbaijan, Zanjan, and Adrebil, to the difficult landing site of the helicopter that was carrying the president and his accompanying delegation.

IRNA: About an hour after the news of the accident involving the Iranian president’s helicopter was announced, rescue teams arrived at the announced location and began search operations.

IRNA: 20 rescue teams and drones were sent to the area, but due to the inability to cross the area and its mountainous and forested conditions, as well as unfavorable weather conditions, especially dense fog, the search and rescue operation will take time.

Fars Agency calls on Iranians to pray for President Raisi following reports of the crash of the helicopter in which he was traveling. LINK

************

Clare: Iraq offers assistance to Iran to search for the missing president

5/19/2024 Baghdad –

Today, Sunday, Prime Minister Muhammad Shiaa Al-Sudani directed the Ministry of Interior, the Iraqi Red Crescent, and other competent authorities to present the capabilities available on the Iranian side to assist in the search for the Iranian president’s missing plane.

A statement from the media office, a copy of which was received by 964 Network , stated :

Prime Minister Muhammad Shiaa Al-Sudani directs the Ministry of Interior, the Iraqi Red Crescent, and other competent authorities to present the capabilities available to the Islamic Republic of Iran to assist in the search for the Iranian president’s plane that went missing in northern Iran.

Rescue teams are still searching for the Iranian president’s helicopter, which disappeared from radars. The authorities in Iran do not provide much information about what happened, but Iranian Interior Minister Ahmed Vahidi used the phrase “hard landing” to describe what happened to the president’s helicopter.

The Iranian Red Crescent said that the last appearance of the president’s helicopter, according to monitoring devices, was near a copper mine located in the “Dizmar” forest area between the villages of “Uzi and Pir Daoud” in East Azerbaijan province, while an Iranian official told Reuters, “We still have hope of finding the president, but “The information from the accident site is very disturbing.”

Rescue teams say that they were forced to stop aerial search operations, due to the intensity of fog in the area, and that they will continue operations by land, in rugged areas and within forests.

At the shrine of Imam Ali Ibn Musa al-Rida, in the city of Mashhad, northeast of the country, worshipers raised their hands to pray for the safety of their president, as well as at the shrine of Lady Masoumeh in the city of Qom in the center of the country. LINK

A Reading Of The Financial And Monetary Policies Of The International Monetary Fund Report - May 2024

A Reading Of The Financial And Monetary Policies Of The International Monetary Fund Report - May 2024

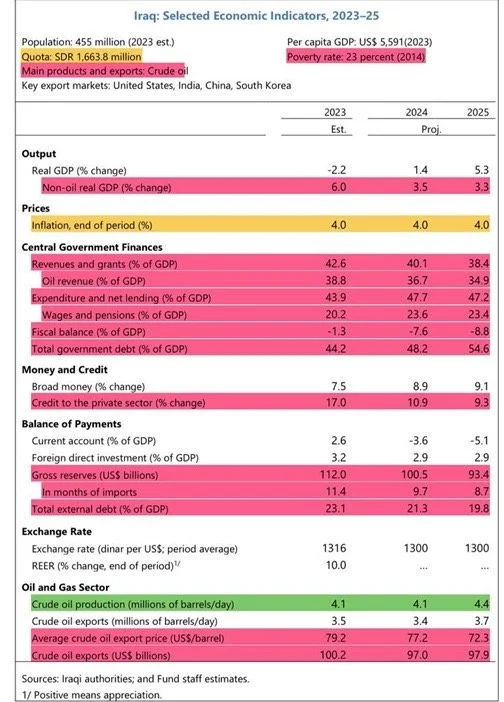

Ali Daadoush Economy News – Baghdad The report showed important data for the Iraqi economy during the period (2020-2023), actual and forecasts for the year 2024, and then predictions of the course of economic policy during the period (2025-2029), and

according to the data of the main table listed below, the data for Special Drawing Rights (SDR), inflation, and crude oil production were stable. To some extent,

but the other data were unstable, and some of them even portend danger in the coming years, especially for financial policy, in which the extent of the government’s intervention in the economy became apparent in terms of large expenditures, specifically the salaries, wages, and retirement sections, as well as the rise in public debt to levels of the danger zone, which are extremely high. (60%) of the gross domestic product.

Although oil output represents about 40% of the real gross domestic product, non-oil output represents only a small portion of total revenues and exports, making Iraq highly vulnerable to fluctuations in oil prices.

Moreover, the public sector wage bill (under increasing pressure from compulsory employment policies) remains the highest in the region.

A Reading Of The Financial And Monetary Policies Of The International Monetary Fund Report - May 2024

Ali Daadoush Economy News – Baghdad The report showed important data for the Iraqi economy during the period (2020-2023), actual and forecasts for the year 2024, and then predictions of the course of economic policy during the period (2025-2029), and

according to the data of the main table listed below, the data for Special Drawing Rights (SDR), inflation, and crude oil production were stable. To some extent,

but the other data were unstable, and some of them even portend danger in the coming years, especially for financial policy, in which the extent of the government’s intervention in the economy became apparent in terms of large expenditures, specifically the salaries, wages, and retirement sections, as well as the rise in public debt to levels of the danger zone, which are extremely high. (60%) of the gross domestic product.

Although oil output represents about 40% of the real gross domestic product, non-oil output represents only a small portion of total revenues and exports, making Iraq highly vulnerable to fluctuations in oil prices.

Moreover, the public sector wage bill (under increasing pressure from compulsory employment policies) remains the highest in the region.

This challenge is exacerbated by the lack of development in the private sector, which is hampered by factors including a large state footprint, corruption, bureaucracy, underdeveloped infrastructure, and poor access to credit.

Unemployment rates remain high and labor force participation levels are low, especially among youth and women, and although domestic stability has improved, public reforms still lag in key areas.

PIC

*The red color indicates a danger facing the Iraqi economy, the

yellow color indicates relative stability, and the

green color indicates economic growth.

First: economic policy discussions

Current policies significantly increase the dependence of the Iraqi economy on oil prices, and

to protect macroeconomic stability and sustainability, there must be financial reform (adjustment) that focuses on controlling the wage bill and mobilizing non-oil tax revenues while protecting vital social and investment needs, and this must be complemented by accelerating structural reforms. To stimulate private sector development, including through labor market reforms, restructuring of state-owned banks (Rafidain and Al-Rasheed in particular) and continued anti-corruption efforts.

Second: Financial policy

The fiscal situation is expected to deteriorate in 2024 and beyond, increasing vulnerabilities, and

although IMF staff expect only partial implementation of the investment budget due to capacity constraints, total government spending is expected to remain increasing by 3.8% of GDP in 2024, of which 3.4% is due to higher salaries and pensions (including transfers to the KRG).

Therefore, the deficit is expected to rise to about 7.6% of GDP in 2024 due to the increase in government expenditures, and

in light of the weakness of non-oil revenues and the continued dependence on oil revenues, it is expected that the fiscal deficit will deepen further under the assumption that there are no changes in fiscal policy,

Which forces the government to rely on cash financing, which means the central bank financing government expenditures in exchange for securities (discounting treasury transfers).

This increases government debt from 44% of GDP at the end of 2023 to more than 86% by 2029, resulting in a high risk signal in the medium term.

Fiscal policy reform requires a number of the following measures, including

(mobilizing non-oil revenues and

restrictions on current expenditures, while

protecting capital investment and perhaps

expanding targeted social transfers).

Provisional return estimates indicate that the following list of measures could provide sufficient savings:

A - The focus of any adjustment strategy should be to find savings in the wage bill.

Savings could start with phasing out mandatory staffing requirements, and could be followed up with an attrition-based strategy to adjust the size of government staffing.

Given the role of public sector employment in the Iraqi social contract and the large existing gender employment gaps, such measures must be gender balanced and supported by labor market reform to expand private sector employment opportunities.

B- It must be a mobilization of additional non-oil revenues.

By removing tax exemptions on profitable state institutions, reforming the salary tax and reviewing customs duties in the near term.

Material increases in revenues can be achieved by making payroll taxes more progressive, subjecting public sector allowances to tax, which can be as large as salaries, and personal income tax being withheld at source.

A review of the customs tariff structure, along with unification of customs regulations with the KRG, and the imposition of new duties (for example, on cigarettes) and sales taxes on luxury goods could also contribute to non-oil revenues.

Targeted technical cooperation in tax policy can help enrich and develop the design of these revenue mobilization measures.

Further improvements in revenue and customs administration could also bring in additional revenue.

The authorities should build on the remarkable progress achieved in the ASYCUDA system trial by expanding its use at other border control points and adjusting customs operations in accordance with the new system.

In the medium term, imposing a general sales tax or value-added tax could boost non-oil revenues.

Third: Monetary policy

The Central Bank of Iraq has resorted to using a tight monetary policy to improve the liquidity management framework, and

further liquidity absorption may be needed to support the monetary policy transition.

In response to the sharp increase in excess liquidity, the central bank raised the policy rate from 4% to about 7.5% and reduced funds for subsidized lending initiatives in mid-2023.

However, the penetration of the policy rate was weak due to excess liquidity and lack of market incentives in financial intermediaries. Especially in government banks.

The reserve requirement was also increased from 15% to 18% and the 14-day CBI billing facility was introduced.

After these measures by the monetary authority, the liquidity surplus decreased initially, but it rose again in August 2023 as a result of the implementation of the general budget,

which means the need for more measures to absorb the liquidity surplus, including improving coordination between fiscal and monetary policy towards achieving The goal of price stability.

As the fiscal policy is expansionary through the huge volume of expenditures, it is offset by a contractionary monetary policy through raising interest rates to confront the surplus liquidity in the economy.

Therefore, consideration can be given to increasing reserve require :heart: ments on government deposits, which will help absorb excess liquidity in government banks without harming private banks.

Organizing and securing correspondent banking relationships is crucial to ensuring an easy transition to the new trade finance system.

The authorities must intensify efforts to modernize the banking sector to facilitate the establishment of correspondent banking relationships.

Trade financing before 2023 was done through financial consolidation, but

after the introduction of the compliance platform, trade financing changed, and the

Iraqi Central Bank pre-financed dollar accounts abroad for local commercial banks that had correspondent banking relationships with Citi Bank for trade financing.

This allowed an increase in the share of cross-border payments settled through commercial banks.

At the beginning of 2025, the Central Bank of Iraq plans to fully transition to a supervisory role in settling cross-border payments (import financing).

To facilitate this transition, the Central Bank of Iraq has assisted private banks in securing correspondent banking relationships, including providing guidance on accrediting and evaluating banks in line with best practices. International.

As of the writing of the article, (6) banks have established correspondent relationships with American banks, and

many others have correspondent banking relationships with non-American banks.

Strengthening these efforts is essential to ensure a successful transition to the new trade finance system.

In addition, monetary policy has achieved an important breakthrough in expanding the scope of digital payments, as

many measures have been taken to promote digital payments, including

expanding the use of point-of-sale devices,

obligating the use of electronic payment cards in certain transactions such as purchasing fuel, and

raising transaction ceilings at ATMs.

Automated bank cards and

reduced bank fees.

These efforts are welcome and will help reduce Iraq's dependence on cash and improve financial inclusion, especially for women whose access to financial services may be restricted due to limited mobility and other obstacles.

Monetary policy also worked to integrate the banking sector, as the

Central Bank took a decision to increase the minimum banking capital requirements from 250 to 400 billion Iraqi dinars.

Banks (many of which are small) will either have to inject more capital or submit an M&A plan by the beginning of 2025, and

careful planning and public communication will be critical to achieving the reform goal of improving the efficiency and competitiveness of the private banking sector without creating a From uncertainty about the banks' viability.

However, the implementation of core banking systems, certification of previous financial statements and amendment of regulations to strengthen the governance of state banks remain weak, and the

slow progress in reforming state banks hampers the effective allocation of credit and transmission of monetary policy.

The authorities must continue to strengthen the AML/CFT framework and its effectiveness, including in the banking sector.

These efforts should be guided by the priority actions emerging from the MENAFATF Mutual Evaluation which will conclude in the third quarter of 2024.

Once key areas for further improvement have been identified, seeking more targeted technical assistance can Helps support these efforts.

views 621 05/17/2024 - https://economy-news.net/content.php?id=43504

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

An Economist’s Rule for Making Tough Life Decisions

An Economist’s Rule for Making Tough Life Decisions

Quartz Sarah Todd

"Whenever you cannot decide what you should do, choose the action that represents a change."

“You must change your life,” Rainer Maria Rilke exhorts readers in the final line of his poem “Archaic Torso of Apollo.” It’s a surprise-twist ending, meant to capture the sudden nature of epiphanies. Having spent the entire poem contemplating the beauty of an ancient Greek statue, Rilke practically reaches through the page to shake readers by the shoulders, urging us to transform ourselves—to use our rapidly-dwindling time on Earth as wisely as Apollo’s sculptor did.

But changing your life is a big deal. It takes a lot of work and emotional energy. And it’s often very difficult to predict if a dramatic turn will actually make us happier and more fulfilled, or if it will be the biggest mistake ever and we’ll shrivel up into little raisins of regret.

An Economist’s Rule for Making Tough Life Decisions

Quartz Sarah Todd

"Whenever you cannot decide what you should do, choose the action that represents a change."

“You must change your life,” Rainer Maria Rilke exhorts readers in the final line of his poem “Archaic Torso of Apollo.” It’s a surprise-twist ending, meant to capture the sudden nature of epiphanies. Having spent the entire poem contemplating the beauty of an ancient Greek statue, Rilke practically reaches through the page to shake readers by the shoulders, urging us to transform ourselves—to use our rapidly-dwindling time on Earth as wisely as Apollo’s sculptor did.

But changing your life is a big deal. It takes a lot of work and emotional energy. And it’s often very difficult to predict if a dramatic turn will actually make us happier and more fulfilled, or if it will be the biggest mistake ever and we’ll shrivel up into little raisins of regret.

So we waffle over whether or not to quit a job, change careers, start a business, or go back to school, weighing endless pros and cons. In behavioral economics, this phenomenon is known as status quo bias. People are generally predisposed to favor sticking with their current circumstances, whatever they may be, instead of taking a risk and bushwhacking their way toward a different life.

That’s an instinct we should fight against, according to the findings of a new study by Steven Levitt, University of Chicago economist and Freakonomics co-author, published in Oxford University’s Review of Economic Studies.

The study asked people who were having a hard time making a decision to participate in a randomized digital coin toss on the website FreakonomicsExperiments.com. People asked questions ranging from “Should I quit my job?” to “Should I break up with my significant other?” and “Should I go back to school?” Heads meant they should take action. Tails, they stuck with the status quo.

Ultimately, 20,000 coins were flipped—and people who got heads and made a big change reported being significantly happier than they were before, both two months and six months later.

“The data from my experiment suggests we would all be better off if we did more quitting,” Levitt said in a press release. “A good rule of thumb in decision making is, whenever you cannot decide what you should do, choose the action that represents a change, rather than continuing the status quo.”

Do more quitting may sound like strange advice in the midst of a pandemic that’s mauling the labor market. Those lucky enough to still have a stable income and health insurance may be quite sensibly wary of jettisoning those things for the great unknown.

But dig a little deeper, and Levitt’s suggested rule of thumb for decision-making turns out to be decidedly evergreen, and may even have added significance in current upheavals of the Covid-19 era. We’re biased toward upholding the status quo, but it’s a bias that hurts us.

Flip a Coin, Make a Change

There are plenty of caveats to this experiment, which collected data over the course of a year beginning in 2013. For one thing, as Levitt explains, the subject pool wasn’t at all random.

To Read More: LINK

Iraqi Dinar Video Update Late Saturday Evening 5-18-24

Iraqi Dinar Video Update Late Saturday Evening 5-18-24

US Treasury Big Statement IQD Revaluation – 4:33

Iraq President International Announced IQD New Rate – 3:49

IMF & WTO Released Iraqi Dinar New Rate – 3:50

Iraqi Dinar Massive Exchange Rate – 3:20

Iraqi Dinar Video Update Late Saturday Evening 5-18-24

US Treasury Big Statement IQD Revaluation – 4:33

Iraq President International Announced IQD New Rate – 3:49

IMF & WTO Released Iraqi Dinar New Rate – 3:50

Iraqi Dinar Massive Exchange Rate – 3:20

US Treasury Big Statement IQD Revaluation – 4:33

Iraq President International Announced IQD New Rate 3:49

IMF & WTO Released Iraqi Dinar New Rate – 3:50

Iraqi Dinar Massive Exchange Rate – 3:20

“Tidbits From TNT” Sunday 5-19-2024

TNT:

Tishwash: Al-Sudani will visit Doha tomorrow to participate in the World Security Forum

A political source reported today, Sunday (May 19, 2024), the visit of Prime Minister Muhammad Shiaa Al-Sudani to the Qatari capital, Doha.

The source told "Baghdad Al-Youm", "Prime Minister Muhammad Shiaa Al-Sudani will head tomorrow, Monday, to the Qatari capital, Doha."

He added, "The reason for the visit is to participate in the 2024 World Security Forum."

The activities of the Global Security Forum will begin tomorrow in Doha, and will continue until the 22nd of this month with broad participation from officials, decision makers and policy makers.

The forum witnesses in-depth discussions on many sensitive issues related to global security, with the aim of addressing and discussing the challenges and opportunities posed by the interconnected world link

TNT:

Tishwash: Al-Sudani will visit Doha tomorrow to participate in the World Security Forum

A political source reported today, Sunday (May 19, 2024), the visit of Prime Minister Muhammad Shiaa Al-Sudani to the Qatari capital, Doha.

The source told "Baghdad Al-Youm", "Prime Minister Muhammad Shiaa Al-Sudani will head tomorrow, Monday, to the Qatari capital, Doha."

He added, "The reason for the visit is to participate in the 2024 World Security Forum."

The activities of the Global Security Forum will begin tomorrow in Doha, and will continue until the 22nd of this month with broad participation from officials, decision makers and policy makers.

The forum witnesses in-depth discussions on many sensitive issues related to global security, with the aim of addressing and discussing the challenges and opportunities posed by the interconnected world link

Tishwash: Iraqi Parliament adjourns amid chaos: Failure to elect Speaker leads to physical altercations

As speculated, and in a recurring scenario, the Iraqi Parliament adjourned its session on Saturday evening to an unspecified date after failing to reach a decisive third round in the election of its president.

The competition remained intense between the Siyada bloc’s Salem Al-Issawi and the Taqadum Bloc-backed Mahmoud Al-Mashhadani.

The scene did not differ much from January 3, 2024, as leaked by MPs about today's session, marked by verbal altercations, and physical scuffles, reminiscent of events witnessed and reported five months ago, orchestrated by members of the Taqadum Party under the leadership of Mohammed Al-Halbousi.

MPs' smartphones captured heated verbal exchanges and physical confrontations between members of the Taqadum Party and colleagues from other blocs over the election of the parliament's president.

Mishaan al-Jubouri, a leader in the Siyada Party, posted on the X, " When the quorum reached 190 deputies, Taqadum’s MPs set up a barrier between the seats and the presidency platform."

Al-Jubouri added that "MP Haibat Al-Halbousi from Taqadum assaulted Muthanna Al-Samarrai, the head of the Azm bloc, prompting MP Ahmed al-Jubouri to strike Haibat."

This incident highlights the tensions and physical confrontations that marred the proceedings during the parliament's session.

Prior to this, MPs from Taqadum demanded amendments to the parliament's internal regulations before proceeding with the voting round, fearing Salem Al-Issawi's potential victory in the third round, according to a parliamentary source.

While the quorum was complete, several Taqadum MPs opposed proceeding with the vote unless the internal regulations of the parliament were amended.

These demands led to chaos inside the council, escalating later into physical brawls and verbal abuse between MPs from the Taqadum Party and others from different blocs, as shown in leaked footage.

Yet again, the Iraqi Parliament failed to elect a new president in its second round of voting, which saw intense competition between Al-Issawii and Al-Mashhadani. The former garnered 158 votes while the latter received 137 votes.

Against the backdrop of this vote convergence, a state of division prevailed among political blocs. The Siyada and Al-Azm, alongside others aligned with them, as well as MPs supporting Salem Al-Issawi, insisted on continuing the session and initiating a third round to elect a new parliament president.

However, other blocs, including the State of Law, Taqadum, and Al-Sadara, supporting Mahmoud Al-Mashhadani for the parliament presidency, pushed for postponing the session to a later date, according to a parliamentary source.

Notably, on November 14, 2023, the Federal Supreme Court, the highest judicial authority in Iraq, decided to end the membership of Parliament Speaker Mohammed al-Halbousi. Then, the Iraqi Parliament officially terminated his membership on November 21, 2023.

On January 13, the Iraqi Parliament held an extraordinary session to choose the new Speaker. However, due to verbal altercations inside the council hall, the session was adjourned without completing the election process.

Nearly half a year after the dismissal of Al-Halbousi, the parliamentary council has again failed, for the fifth time, to settle the issue, thereby stalling the enactment of crucial legislation. link

************

CandyKisses: Cabinet holds extraordinary session to discuss budget tables for 2024

Shafaq News / The Council of Ministers held, on Sunday, an extraordinary session chaired by Prime Minister Mohamed Shia Al-Sudani to discuss the tables of the federal budget for the year 2024.

This session comes as Al-Sudani is scheduled to head tomorrow, Monday, to the Qatari capital, Doha, to participate in the Global Security Forum for the year 2024.

At the end of April, Acting Speaker of the House of Representatives Mohsen al-Mandalawi agreed with Prime Minister Mohamed Shia al-Sudani on the need to complete the schedules of the 2024 budget law and expedite sending them to the House of Representatives for discussion and voting, as they are related to the lives of citizens and focus on investment spending for new projects.

In the meantime, the Ministry of Finance referred to the controls contained in the circular of the Budget Department No. 69333 on 24/4/2024 to all ministries, which must be taken into account when approaching the department for the following purposes:

● Transfer of services from one destination to another.

• Request for a grade and job title on political segregation.

● Change job titles.

● Change the address of the unauthorized certificate upon appointment.

● Marking variables: (promotion / calculation of the certificate in accordance with Law No. 103 of 2012 / calculation of the duration of the contract and wage / previous services, press service and service of practicing the legal profession).

● Indication of the period of calculation of the political chapter.

● Promotion to the position of expert.

● Marking of variables of self-financing circles.

************

Tishwash: Paying off external debt is a step to promote stability and recovery

Experts in the field of economics expressed their confidence in the economic and financial reform steps undertaken by the current government under the direct supervision and guidance of Prime Minister Muhammad Shiaa Al-Sudani, and while they pointed out that Iraq’s payment of its foreign debts is a supportive step for financial and economic stability and moving towards recovery, they called for Accelerating the steps to move away from the framework of the “mono-rentier economy” towards a multi-resource economy.

The head of the “Osoul” Foundation for Economic and Sustainable Development, Khaled Al-Jabri, said in an interview with “Al-Sabah”: “Iraq’s payment of all its debts to the International Monetary Fund is a positive step towards enhancing economic stability and improving the country’s financial situation,” indicating that “this achievement has implications.” “There are multiple impacts on the Iraqi economy, in terms of improving the credit rating, as repaying debt enhances Iraq’s credit rating, which may reduce borrowing costs in the future, and it also reflects the country’s ability to fulfill its financial obligations, which increases the confidence of international lenders and investors.”

He added, “Enhancing international confidence confirms Iraq’s commitment to financial and economic reforms and can attract more foreign investments, as investors see that the financial environment has become more stable, and that the financial resources (money) that were used to repay debts can now be allocated to development projects.” And infrastructure, and can contribute to improving public services and increasing spending on health and education.”

Today, Thursday, the Advisor to the Prime Minister for Financial Affairs, Mazhar Muhammad Salih, announced that Iraq has fully repaid all loans provided by the International Monetary Fund since 2003, noting that their total did not exceed 8 billion dollars.

The head of the Al-Sharq Center for Strategic Studies and Information, Ali Mahdi Al-Araji, explained in an interview with “Al-Sabah” that “Iraq’s total debt amounts to about 70 billion dollars, divided into an internal debt worth 50 billion dollars scheduled between the Iraqi banking system and the three government banks (Al-Rasheed, Al-Rafidain, and Al-Basra). Iraqi Trade), and the other part is an external debt amounting to 20 billion dollars, meaning that in total it constitutes only 35 percent of the country’s gross domestic product.

He explained, “Iraq - as it is known - is a rentier country that depends on oil, and this is offset by a significant real exhaustion of the state budget estimated at $42 billion that goes annually between job salaries, retirement, and social care. Perhaps we will face in the future what is called (the Dutch disease), where reliance on... Natural resources and the collapse or decline of the industrial side.

Al-Araji expressed his confidence in “the great efforts of Prime Minister Muhammad Shiaa Al-Sudani to resolve the financial crises in Iraq,” stressing that “we find them to be good steps. There must be a wise administration that controls the country’s cash reserves and seeks to achieve harmony and balance between operational and investment expenses and... Its imports, and repairing the deficit in the trade balance, budget, and payments, to avoid any financial crisis that may afflict the country.” link

Mot: .... Finally!! --- Here Weeeeee - Goooooooooo!!! ((( I Hope )))

“BRICS” News on Sunday 5-19-2024

BRICS to Open a Central Bank Iraqs Relationship to BRICS Exchange Rate Up

Edu Matrix: 5-19-2024

BRICS to Open a Central Bank

Iraq's Relationship to BRICS

Exchange Rate Up

There is no doubt BRICS would like for a country like Iraq to join. Iraq is not only US dollars rich, but also oil rich.

A BRICS Central Bank changes the global line-up.

BRICS to Open a Central Bank Iraqs Relationship to BRICS Exchange Rate Up

Edu Matrix: 5-19-2024

BRICS to Open a Central Bank

Iraq's Relationship to BRICS

Exchange Rate Up

There is no doubt BRICS would like for a country like Iraq to join. Iraq is not only US dollars rich, but also oil rich.

A BRICS Central Bank changes the global line-up.

BRICS Currency Terminates US Dollar: What next?

Fastepo: 5-18-2024

Iran and Russia are forging ahead with plans to create a unified currency for the BRICS+ nations, a groundbreaking initiative announced by Iranian Ambassador to Russia, Kazem Jalali, during the "Russia - Islamic World: KazanForum" in May 2024.

Jalali passionately emphasized Iran's unwavering commitment to this strategic move, which seeks to diminish dependence on the US dollar and foster robust economic cooperation among BRICS countries.

The KazanForum, held from May 14-19, 2024, served as a crucial platform for discussing this ambitious project.

Iran's active participation in BRICS aligns with its broader objectives of mitigating the effects of US sanctions and strengthening economic ties with key global players like China and Russia.

This initiative is a significant component of a larger effort to develop a blockchain-based digital currency payment system, designed to ensure more secure and efficient cross-border transactions within the BRICS framework.

News, Rumors and Opinions Sunday AM 5-19-2024

KTFA:

Frank26: "AS WE SUGGESTED THE MONETARY REFORM EDUCATION WOULD BECOME LOUDER TO THE CITIZENS AND RIGHT NOW FLOATING IS THE TOPIC... WITH NO MENTION OF A BASKET... EXACTLY AS WE TOLD YOU."...........F26

"THE MOMENT THEY RELEASE THE NEW EXCHANGE RATE AND NEW LOWER NOTES... THE FLOAT AUTOMATICALLY STARTS ON FOREX!!!"............F26

Floating the dinar... Will it achieve monetary stability in Iraq?

May 17, 2024 The stability of the Iraqi dinar in recent years has always faced major challenges, as it witnesses price fluctuations, not to mention a gap between what the central bank determines and what is sold in the parallel market.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

Read full post here: LINK

KTFA:

Frank26: "AS WE SUGGESTED THE MONETARY REFORM EDUCATION WOULD BECOME LOUDER TO THE CITIZENS AND RIGHT NOW FLOATING IS THE TOPIC... WITH NO MENTION OF A BASKET... EXACTLY AS WE TOLD YOU."...........F26

"THE MOMENT THEY RELEASE THE NEW EXCHANGE RATE AND NEW LOWER NOTES... THE FLOAT AUTOMATICALLY STARTS ON FOREX!!!"............F26

Floating the dinar... Will it achieve monetary stability in Iraq?

May 17, 2024

The stability of the Iraqi dinar in recent years has always faced major challenges, as it witnesses price fluctuations, not to mention a gap between what the central bank determines and what is sold in the parallel market.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

Read full post here: LINK

Frank26: "STUDY AFTER STUDY OF THE FLOAT FOR THE MONETARY REFORM... IS NEXT"...........F26

Floating the Iraqi dinar...a solution to fill the “gap” of its troubled price against the dollar

5/17/2024

The stability of the Iraqi dinar has been facing major challenges for years, as it has witnessed price fluctuations that have not stabilized, especially with the rapid rise and very slow decline of the price of the dollar, in addition to a gap between what the Central Bank of Iraq determines and what is sold in the parallel market, especially in banking shops that do not adhere to According to the instructions of the Central Bank.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

The cash selling price, according to the Central Bank, is 1,305 dinars per dollar, while the price for transfers abroad is 1,310 dinars per dollar, and the price in the parallel market is about 1,450 dinars per dollar in mid-May, according to local media, while it reached levels of 1,600 dinars per dollar in previous periods.

For months, the Iraqi authorities have imposed restrictions in their efforts to control exchange rates, restricting all commercial transactions within the country to the Iraqi dinar, and established a new mechanism that subjects external transfers to greater scrutiny.

Iraqi economic analysts who spoke to Al-Hurra website, some of them warned against taking a decision that would lead to floating the dinar, while some of them believe that a moderate policy could be taken that suits the Iraqi economy, based on “floating” and “stabilization” at the same time.

Is the flotation policy compatible with the Iraqi economy?

Advisor to the Prime Minister for Financial Affairs, Mazhar Salih, believes that floating the currency price does not suit the Iraqi economy, especially since it is a "rentier economy, dominated by foreign currency reserves."

He explains in statements to the “Al-Hurra” website that “the economic vision that wants to float the Iraqi dinar to end the gap between the official price and the parallel price may be possible in an economy in which the free market alone influences the movement of the balance of payments, and not in an economy in which the rentier government sector is dominant and generates reserves.” Foreign currency".

He added, "The monetary authority in Iraq alone is the main source of supply of foreign currency that meets the desired demand for foreign exchange in the local market."

Saleh believes that the demands for flotation inevitably mean “adopting the prevailing exchange rate in the parallel market, in order to achieve the goal of stability and balance in the official exchange rate itself at a new exchange point that the market will reach at the end of the assumed flotation policy and return to stability again.”

The flotation scenario also means “the withdrawal of the monetary authority as the main central offerer of foreign currency, and its replacement by new forces of free market makers, which certainly have only a weak, limited supply of foreign exchange,” according to Saleh.

He points out that these forces carry “an uncontrolled package of inflationary expectations, and are called in the economic literature (the forces generating inflationary expectations), which will give dominance to the supply forces of speculators” who own limited amounts of foreign exchange, matched by “an open demand for foreign currency from The market side" exceeds what is offered by "at least more than ten times in our estimate."

Chancellor Saleh described this policy as “unruly,” as as long as “the central government supply of foreign currency will be absent from the market, we will not obtain any equilibrium point in the exchange rate that flotation seeks except with a widespread deterioration of the exchange rate as long as it is carried out by forces generating inflationary expectations in a severe rentier economy.” "unilateralism."

He warns that if the exchange rate moves in “a market that is incomplete, in terms of productivity, in its compensation for the required supply of goods and services,” no one “will know how much the new exchange rate resulting from the flotation will be,” which will be accompanied by “a prior wave of inflationary expectations,” the trends of which are difficult to control. Which may push monetary policy makers to “intervene with excessive foreign reserves and unjustified waste in foreign exchange to impose a state of stability.”

According to the World Bank, Iraq has 145 billion barrels of proven oil reserves, which are among the largest crude oil reserves in the world.

But Iraq hopes that the country's oil reserves will exceed 160 billion barrels, according to what the Minister of Oil, Hayyan Abdul Ghani, recently announced.

What if the Iraqi dinar was floated?

The claims that have appeared every now and then for years calling for floating the exchange rate of the Iraqi dinar are “strange,” and most of them are made by people who are “not specialized in economics or monetary policy,” according to what Professor of International Economic Relations, Abdul Rahman al-Mashhadani, confirms to the Al-Hurra website.

He asserts in a decisive tone, "Iraq cannot proceed with floating the dinar's exchange rate. The evidence for this is all the agreements concluded with the International Monetary Fund since 2004, and the reviews praised the stabilization of the exchange rate by the Central Bank of Iraq."

Al-Mashhadani added that there was a study by experts at the World Bank during the past years that recommended “raising the exchange rate,” noting that even then, “these recommendations cannot be taken into account because the World Bank is concerned with what is related to economic development, but following up on the recommendations for monetary policies is taken into account if It was from the International Monetary Fund.

In its latest review on Thursday, the International Monetary Fund praised the efforts of the Central Bank of Iraq to tighten monetary policy and strengthen its liquidity management framework.

He explains that “the real gap is in the wheel of production in the Iraqi economy, as the majority of goods are imported from abroad, which means that the flotation will cause a spiral in price rates to become significantly high and affect the marginalized classes,” indicating that such a decision cannot be taken “as a matter of politics.” “Cash” only, as we must “consider the burdens it will impose on citizens.”

Al-Mashhadani confirms that what has been applied in other Arab countries does not “mean that it can be applied to the Iraqi economy,” suggesting that “the exchange rate will become at the levels of 5,000 dinars to the dollar,” as “the Central Bank has lost control over exchange rates, leaving them to float.”

There is a fear that “floating” will cause “social” problems, as “salaries will erode significantly,” which may threaten “new classes to slide into poverty,” while “a class of merchants, politicians, and businessmen will benefit, who will benefit from the state of instability that will result from... This matter".

Al-Mashhadani agrees that floating in the end means “that the parallel market will control exchange rates,” but it will not achieve “the desired monetary stability,” as the central bank will then need to “print more local currency to keep up with demand in the markets,” and the government will need to increase salaries and allocations for aid packages. Social.

The Iraqi government advisor, Saleh, attributes the reason and existence of a “gap” in the dinar’s exchange rates against the dollar between the official and parallel markets to “external factors imposed by the compliance platform and auditing administrative restrictions on external transfer movements, which is not related to the deficit in the authority’s monetary reserves,” noting that the reserve Iraq's foreign currency is considered the highest in the country's history, as it touches the levels of import coverage for 16 months, compared to the global standard, which does not exceed three months of import coverage.

Financial transfers in dollars through official channels have increased significantly in Iraq, while Iraq continues its reforms of the financial sector in line with international standards, according to a previous report by Agence France-Presse.

In late 2022, the Iraqi banking sector adopted the SWIFT electronic transfer system with the aim of providing better control over the use of the dollar, ensuring compliance with US sanctions on Tehran, and also in order to limit the prosperity of the informal economy.

The financial standards that were adopted encouraged the emergence of a parallel market for currencies, attracting those seeking to obtain dollars outside official channels.

Saleh pointed out that there is a distortion in support for the prices of some commodities “on the part of financial policy, which is support in which the rich and poor mostly enjoy it equally without discrimination, and it represents an added, imperceptible real income, and it is the product of a financial policy inherited from the consumer welfare state for the rentier resource.”

He continued, "It is inconceivable until this moment that 90 percent of Iraq's population is receiving food support provided by the state as an extension of the economic blockade phase of the 1990s, in light of the changing standards of living and lifestyle, the increasing number of affluent people, and the growth of the middle class." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Bruce [WiserNow] We know that...Iraq paid back the IMF – a loan that they got in 2003...that's when the new 25 10,000 5000 1000 dinar notes were printed. Our notes that we have now are printed starting in 2003. And they paid the IMF back at $8 billion against a loan Iraq received in 2003... Now, to do that, you had to have a revalued dinar...to make that doable...the rates are actually on the ATM’s in Baghdad in airports and other places. So have they converted over to I think the new rate in country – yes... they're keeping it hidden until they're ready for everything to be released.

Frank26 The monetary reform can come back at $3.22 and let it float to the real effective exchange rate...IMO the CBI will float it too somewhere between $3.86 and about $4.25 before they consider to cap it.

The Purchasing Power Of The Dollar Will Be ZERO

Lynette Zang: 5-18-2024

Iraqi Dinar Video Update Saturday Afternoon 5-18-24

Iraqi Dinar Video Update Saturday Afternoon 5-18-24

Congratulation It's Good News For Dong Holder's – 4:41

Iraqi Dinar Chase Bank Big Announced Today – 3:26

WOW Iraqi Dinar Floating 1 TO 1 Exchange Rate – 4:48

Iraqi Dinar Big Revaluation Last 24 Hours – 4:58

Iraqi Dinar Video Update Saturday Afternoon 5-18-24

Congratulation It's Good News For Dong Holder's – 4:41

Iraqi Dinar Chase Bank Big Announced Today – 3:26

WOW Iraqi Dinar Floating 1 TO 1 Exchange Rate – 4:48

Iraqi Dinar Big Revaluation Last 24 Hours – 4:58

Congratulation It's Good News For Dong Holder's – 4:41

Iraqi Dinar Chase Bank Big Announced Today – 3:26

WOW Iraqi Dinar Floating 1 TO 1 Exchange Rate – 4:48

Iraqi Dinar Big Revaluation Last 24 Hours – 4:58

Iraq Economic News and Points to Ponder Late Saturday Evening 5-18-24

Iraq Economic News and Points to Ponder Late Saturday Evening 5-18-24

An economist warns of the worsening of Forex trade.. “It is being exploited to smuggle the dollar.”

May 16 Information/private.. Economic expert Nabil Al-Marsoumi stressed today, Thursday, the necessity of adopting legal legislation to regulate the worsening Forex trade in Iraq, adding that it could be used to smuggle hard currency abroad. Al-Marsawi said in an interview with the Maalouma Agency,

“There are many segments of society that have begun to use it after opening public Forex trading offices,” noting that “leaving things loose in this way will make them exploited in the file of money laundering and corruption.” He continued, "The operation is large and has included trade in gold, oil, and the dollar, and there are no accurate statistics for it yet," pointing out that "the matter is not limited to large capitals, but even employees and people with middle income."

He continued, "The escalation of such operations will contribute to the depletion of the country's financial and economic situation," pointing out that "it is possible that this trade will be used to smuggle hard currency abroad."

Iraq Economic News and Points to Ponder Late Saturday Evening 5-18-24

An economist warns of the worsening of Forex trade.. “It is being exploited to smuggle the dollar.”

May 16 Information/private.. Economic expert Nabil Al-Marsoumi stressed today, Thursday, the necessity of adopting legal legislation to regulate the worsening Forex trade in Iraq, adding that it could be used to smuggle hard currency abroad. Al-Marsawi said in an interview with the Maalouma Agency,

“There are many segments of society that have begun to use it after opening public Forex trading offices,” noting that “leaving things loose in this way will make them exploited in the file of money laundering and corruption.” He continued, "The operation is large and has included trade in gold, oil, and the dollar, and there are no accurate statistics for it yet," pointing out that "the matter is not limited to large capitals, but even employees and people with middle income."

He continued, "The escalation of such operations will contribute to the depletion of the country's financial and economic situation," pointing out that "it is possible that this trade will be used to smuggle hard currency abroad."

In an interview with the Al-Ma’louma Agency, Ali Al-Zubaidi, a member of the Al-Fateh Alliance, called for the need for the government and the central bank to control the currency selling platform and not other countries, while he stressed that the high rates of remittances through Forex trading represent the other side of money laundering. Ended 25/Y

https://almaalomah.me/news/64733/economy/اقتصادي-يحذر-من-تفاقم-تجارة-الفوركس-تستغل-لتهريب-الدولار

Forex Trading"... A Gateway To Money Laundering And Corruption Or Smuggling Of Green Currencies?

May 16 Information / private.. In light of the lack of financial oversight and excessive openness in many files,

Forex trade is entering forcefully, with frightening numbers of digital money transfers reaching billions of dollars annually, according to actual economic reports and studies, amid warnings of its deterioration to greater proportions that contribute to the smuggling of hard currency abroad.

According to observers, this trade was not limited only to those with huge capital, but also reached middle-income people and employees, and

it could be exploited for money laundering and corruption given the lack of clear legislation and legal materials for it.

*Money Laundering!

Speaking about this file, Ali Al-Zubaidi, a member of the Al-Fateh Alliance, calls for the

need for the government and the central bank to control the currency selling platform and not other countries, while he stressed that the

high rates of remittances through Forex trading represent the other side of money laundering.

Al-Zubaidi said in an interview with the Maalouma Agency,

“The continued entry and exit of money without oversight or accountability affects political and societal stability,” noting that “tightening control over transfers to banks will end many financial violations.”

He continues, "We do not know if there are legal provisions that allow making external transfers through Forex trading,"

calling on "the government to impose its control over the border crossings and prevent the smuggling operations that occur there."

Al-Zubaidi continues his speech:

“Most of the illegal and criminal transactions are carried out through the Forex transfer system,” pointing out that

“the high rates of transfers through Forex represent the other side of money laundering.”

*Dollar Smuggling

In addition, economic expert Nabil Al-Marsoumi stresses the

necessity of adopting legal legislation to regulate the worsening Forex trade in Iraq, adding that it could be used to smuggle hard currency abroad.

Al-Marsawi said in an interview with the Maalouma Agency,

“There are many segments of society that have begun to use it after opening public Forex trading offices,” noting that

“leaving things loose in this way will make them exploited in the file of money laundering and corruption.” He continues,

"The operation is large and has included trade in gold, oil, and the dollar, and

there are no accurate statistics for it yet," pointing out that

"the matter is not limited to large capitals, but even employees and people with middle income."

He added,

"The escalation of such operations will contribute to the depletion of the country's financial and economic situation," pointing out that

"it is possible that this trade will be used to smuggle hard currency abroad."

A report confirms, according to studies conducted, that Forex trade in Iraq amounts to more than $100 billion annually with money far from state control, marred by fraud, money laundering, and illegal operations that link young people to illusory dreams of quick and easy wealth. Ended 25/Y

Disclosure Of Draft Laws To Develop The Banking Sector

May 16 Information / Baghdad.. Representative Mahma Khalil revealed today, Thursday, the

imminent enactment of several laws to develop the banking system in Iraq. Khalil told Al-Maalouma, “The

banking sector suffers from neglect compared to international banks, indicating that

rehabilitating the banking sector needs more legislation.” He added,

"Iraqi banks have lagged far behind international banks, which are witnessing major developments day after day in their use and reliance on modern technological means." He pointed out that

“complying with international laws and controlling dollar smuggling are not sufficient steps to reach the level of ambition and help compete with developed countries.” Ended / 25h

https://almaalomah.me/news/64684/economy/الكشف-عن-مشاريع-قوانين-لتطوير-القطاع-المصرفي

To read more current and reliable Iraqi news please visit : https://www.bondladyscorner.com/

Provoking Thoughts and Points to Ponder on Advice :

Don't fight forces; use them. - Buckminster Fuller

Drink nothing without seeing it; sign nothing without reading it. - Spanish proverb

What is important is to keep learning, to enjoy challenge, and to tolerate ambiguity. In the end there are no certain answers. - Marina Horner

Simplicity, simplicity, simplicity. I say, let your affairs be as two or three, and not a hundred or a thousand; instead of a million count half a dozen, and keep your accounts on your thumbnail. - Henry David Thoreau

You must not think, sir, to catch old birds with chaff. - Cervantes

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by: * United Kingdom * United States * Italy * Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq.

It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

Goldilocks' Comments and Global Economic News Saturday Evening 5-18-24

Good evening Dinar Recaps,

"Last week, in a letter to the council, Iraqi Prime Minister Mohamed Shia al-Sudani called for the United Nations Assistance Mission for Iraq (UNAMI), which has been operational since 2003, to end by December 31, 2025."

Resolution 1770 (2007) was devised to give guidance for Iraq on internal protocols that would enable them to secure a safe environment for their people and become prosperous in the world around them.

The resolution was co-sponsored by:

* United Kingdom

* United States

* Italy

* Slovakia

There will be a meeting at the end of May to discuss the gradual removal of the United Nations' involvement with Iraq. It is believed that they have achieved their goals with Iraq, and they believe Iraq's ability to move forward on their own is showing consistent progress.

The UN's involvement with Iraq has been taking place since 2003. It has been a team of leaders from several Nations engaged in helping Iraq "transition" their political and economic economy into a place whereby their contribution to the world is capable of moving to a level of Independence.

Starting early June, Iraq will be gradually moving into their own. These stages of the independence will be monitored, but their control over their own Nation will increase with each passing day. Kurdistan24 Iraq UN

© Goldilocks

~~~~~~~~~

Hong Kong officially launches pilot for digital yuan payments | Business Times

"HONG Kong launched a pilot programme enabling digital yuan payments through major Chinese banks, the first example of China’s currency project being deployed beyond the mainland.

Residents of the city can now open digital yuan wallets with Bank of China, Bank of Communications, China Construction Bank and Industrial and Commercial Bank of China to pay merchants in mainland China directly, Hong Kong’s de facto central bank said in a statement on Friday (May 17)."

Hong Kong has officially launched a pilot program that will allow them to utilize the Yuan as a form of payment.

Users can use the FPS payment system. FPS stands for Faster Payments Service. FPS is a UK banking initiative allowing real-time electronic fund transfers between banks.

© Goldilocks

~~~~~~~~~

Resolution 1770 (2007) / adopted by the Security Council at its 5729th meeting, on 10 August 2007 | United Nations Digital Library System

~~~~~~~~~

Silver Daily Forecast and Technical Analysis for May 17, 2024, by Chris Lewis for FX Empire | Youtube

~~~~~~~~~

The days of shorting the silver market are coming to an end.

~~~~~~~~~

SEC Adopts Rule Amendments to Regulation S-P to Enhance Protection of Customer Information | SEC

~~~~~~~~~

Kraken ‘Actively Reviewing’ Tether’s Status Under New EU Rules | BloombergLaw

New regime for digital assets set to take effect in July

Tether says it plans to continue its dialog with regulators

Kraken is “actively reviewing” plans that may include removing support for the world’s most-traded cryptocurrency on its exchange in the European Union, under a new regime for digital assets that’s set to take effect in the bloc in July.

Tether Holdings Ltd.’s USDT, a stablecoin that aims to maintain a one-to-one value with the dollar, is expected to be impacted by upcoming EU rules known as MiCA.

~~~~~~~~~

Standard Chartered completes first Euro transactions on Partior Platform – Trade Finance Global

~~~~~~~~~

Eurosystem completes first DLT experiment - Central Banking

The Eurosystem completed its first experiment using distributed ledger technology (DLT), the European Central Bank (ECB) announced on May 14.

This is the first of three experiments the ECB plans to carry out. All three experiments will test interoperability-type solutions for central bank money settlement of wholesale financial transactions recorded on DLT platforms.

This experiment covered tokenization and simulated the deliver-versus-payment (DvP) settlement of government bonds in a secondary market transaction against central bank money.

The DLT platform for the experiment was provided by the National Bank of Austria. Other participants include the central banks of Germany, France, Italy and Luxembourg.

👆 Goldilocks pointed to this article

~~~~~~~~~

Is Blockchain the Key to Transforming the Global Tourism Industry? | Analytics Insight

~~~~~~~~~

‘All UAE banks have to launch Jaywan debit cards’: Rollout to happen in phases - News | Khaleej Times

~~~~~~~~~

WATCH & LISTEN HERE Video on XRP

~~~~~~~~~

They Are Dumping Our TREASURIES - The Economic Ninja | Youtube

~~~~~~~~~

Miners Eye Middle East as Next Region for Growth | Coindesk

~~~~~~~~~

Iraq Going for the International Investment Platform? | Youtube

~~~~~~~~~

Join the Seeds of Wisdom Team SNL call with Freedom Fighter breaking down Goldilock's weekly posts! Jester will be joining too! SNL Call Link

9 pm EDT / 8 pm CDT / 6 pm PDT

The SNL Q & A room will be open at 8 pm ET, 7 pm CT, and 5 pm PT to ask questions that will be answered on the call!

The call will be recorded and you can find it in the Archive Call Room after the call is over.

~~~~~~~~~

UNDP endorses Iraq’s electronic payment services system | Search4Dinar

Today, the United Nations Development Programme (UNDP) approved the electronic payment system in Iraq.

© Goldilocks

~~~~~~~~~

Follow Goldilocks' Roadmap

Follow Goldilocks' Timeline

Goldilocks' Telegram Room

Q & A Telegram Room

Goldilocks on the Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Floating the dinar... Will it achieve monetary stability in Iraq?

KTFA:

Clare: Floating the dinar... Will it achieve monetary stability in Iraq?

Moaz Fraihat - Washington May 17, 2024 The stability of the Iraqi dinar in recent years has always faced major challenges, as it witnesses price fluctuations, not to mention a gap between what the central bank determines and what is sold in the parallel market.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

The cash selling price, according to the Central Bank, is 1,305 dinars per dollar, while the price for transfers abroad is 1,310 dinars per dollar, and the price in the parallel market is about 1,450 dinars per dollar in mid-May, according to local media , while it reached levels of 1,600 dinars per dollar in previous periods.

KTFA:

Clare: Floating the dinar... Will it achieve monetary stability in Iraq?

Moaz Fraihat - Washington May 17, 2024

The stability of the Iraqi dinar in recent years has always faced major challenges, as it witnesses price fluctuations, not to mention a gap between what the central bank determines and what is sold in the parallel market.

In order to avoid the “volatility” syndrome and the “gap” in the price of the Iraqi dinar against foreign currencies, some experts believe that the solution lies in a kind of “surgical” operation for the country’s monetary system that may be painful, but it achieves long-term monetary stability for the national currency through... "float".

The cash selling price, according to the Central Bank, is 1,305 dinars per dollar, while the price for transfers abroad is 1,310 dinars per dollar, and the price in the parallel market is about 1,450 dinars per dollar in mid-May, according to local media , while it reached levels of 1,600 dinars per dollar in previous periods.

For months, the Iraqi authorities have imposed restrictions in their efforts to control exchange rates, restricting all commercial transactions within the country to the Iraqi dinar, and established a new mechanism that subjects external transfers to greater scrutiny.

Iraqi economic analysts who spoke to Al-Hurra website, some of them warned against taking a decision that would lead to floating the dinar, while some of them believe that a moderate policy could be taken that suits the Iraqi economy, based on “floating” and “stabilization” at the same time.

Is the flotation policy compatible with the Iraqi economy?

Advisor to the Prime Minister for Financial Affairs, Mazhar Salih, believes that floating the currency price does not suit the Iraqi economy, especially since it is a "rentier economy, dominated by foreign currency reserves."

He explains in statements to the “Al-Hurra” website that “the economic vision that wants to float the Iraqi dinar to end the gap between the official price and the parallel price may be possible in an economy in which the free market alone influences the movement of the balance of payments, and not in an economy in which the rentier government sector is dominant and generates reserves.” Foreign currency".

He added, "The monetary authority in Iraq alone is the main source of supply of foreign currency that meets the desired demand for foreign exchange in the local market."

Saleh believes that the demands for flotation inevitably mean “adopting the prevailing exchange rate in the parallel market, in order to achieve the goal of stability and balance in the official exchange rate itself at a new exchange point that the market will reach at the end of the assumed flotation policy and return to stability again.”

The flotation scenario also means “the withdrawal of the monetary authority as the main central offerer of foreign currency, and its replacement by new forces of free market makers, which certainly have only a weak, limited supply of foreign exchange,” according to Saleh.

He points out that these forces carry “an uncontrolled package of inflationary expectations, and are called in the economic literature (the forces generating inflationary expectations), which will give dominance to the supply forces of speculators” who own limited amounts of foreign exchange, matched by “an open demand for foreign currency from The market side" exceeds what is offered by "at least more than ten times in our estimate."

Chancellor Saleh described this policy as “unruly,” as as long as “the central government supply of foreign currency will be absent from the market, we will not obtain any equilibrium point in the exchange rate that flotation seeks except with a widespread deterioration of the exchange rate as long as it is carried out by forces generating inflationary expectations in a severe rentier economy.” "unilateralism."

He warns that if the exchange rate moves in “a market that is incomplete, in terms of productivity, in its compensation for the required supply of goods and services,” no one “will know how much the new exchange rate resulting from the flotation will be,” which will be accompanied by “a prior wave of inflationary expectations,” the trends of which are difficult to control. , which may push monetary policy makers to “intervene with excessive foreign reserves and unjustified extravagance in foreign exchange to impose a state of stability.”

According to the World Bank, Iraq has 145 billion barrels of proven oil reserves, which are among the largest crude oil reserves in the world.

But Iraq hopes that the country's oil reserves will exceed 160 billion barrels, according to what the Minister of Oil, Hayyan Abdul Ghani, recently announced.

What if the Iraqi dinar was floated?

The claims that have appeared every now and then for years calling for floating the exchange rate of the Iraqi dinar are “strange,” and most of them are made by people who are “not specialized in economics or monetary policy,” according to what Professor of International Economic Relations, Abdul Rahman al-Mashhadani, confirms to the Al-Hurra website.

He asserts in a decisive tone, "Iraq cannot proceed with floating the dinar's exchange rate. The evidence for this is all the agreements concluded with the International Monetary Fund since 2004, and the reviews praised the stabilization of the exchange rate by the Central Bank of Iraq."

Al-Mashhadani added that there was a study by experts at the World Bank during the past years that recommended “raising the exchange rate,” noting that even then, “these recommendations cannot be taken into account because the World Bank is concerned with what is related to economic development, but following up on the recommendations for monetary policies is taken into account if It was from the International Monetary Fund.

In its latest review on Thursday, the International Monetary Fund praised the efforts of the Central Bank of Iraq to tighten monetary policy and strengthen its liquidity management framework.

He explains that “the real gap is in the wheel of production in the Iraqi economy, as the majority of goods are imported from abroad, which means that the flotation will cause a spiral in price rates to become significantly high and affect the marginalized classes,” indicating that such a decision cannot be taken “as a matter of politics.” “Cash” only, as we must “consider the burdens it will impose on citizens.”

Al-Mashhadani confirms that what has been applied in other Arab countries does not “mean that it can be applied to the Iraqi economy,” suggesting that “the exchange rate will become at the levels of 5,000 dinars to the dollar,” as “the Central Bank has lost control over exchange rates, leaving them to float.”

There is a fear that “floating” will cause “social” problems, as “salaries will erode significantly,” which may threaten “new classes to slide into poverty,” while “a class of merchants, politicians, and businessmen will benefit, who will benefit from the state of instability that will result from... This matter".

Al-Mashhadani agrees that floating in the end means “that the parallel market will control exchange rates,” but it will not achieve “the desired monetary stability,” as the central bank will then need to “print more local currency to keep up with demand in the markets,” and the government will need to increase salaries and allocations for aid packages. Social.

"Float with controls" for full "editing".

The economic expert, Manar Al-Obaidi, recommends following a “currency float” policy, but with controls such that a “managed float policy is used to gradually liberalize the currency until complete liberalization of the exchange rate is reached.”

He said in a post on his Facebook account, "Such a policy could be a successful alternative in Iraq by following a managed float policy where the central bank controls the range of volatility and works to gradually increase it until the currency is completely liberalized."

Al-Obaidi gave the example of “the managed flotation policy followed by Morocco in 2018,” noting that it was accompanied by the abolition of customs tariffs on basic materials and “supporting funds for vulnerable classes,” stressing that this experience can be used to influence “inflation.”

"Reasons for the exchange rate “gap”.

The Iraqi government advisor, Saleh, attributes the reason and existence of a “gap” in the dinar’s exchange rates against the dollar between the official and parallel markets to “external factors imposed by the compliance platform and auditing administrative restrictions on external transfer movements, which is not related to the deficit in the authority’s monetary reserves,” noting that the reserve Iraq's foreign currency is considered the highest in the country's history, as it touches the levels of import coverage for 16 months, compared to the global standard, which does not exceed three months of import coverage.

Financial transfers in dollars through official channels have increased significantly in Iraq, while Iraq continues its reforms of the financial sector in line with international standards, according to a previous report by Agence France-Presse.

In late 2022, the Iraqi banking sector adopted the SWIFT electronic transfer system with the aim of providing better control over the use of the dollar, ensuring compliance with US sanctions on Tehran, and also in order to limit the prosperity of the informal economy.

The financial standards that were adopted encouraged the emergence of a parallel market for currencies, attracting those seeking to obtain dollars outside official channels.

Saleh pointed out that there is a distortion in support for the prices of some commodities “on the part of financial policy, which is support in which the rich and poor mostly enjoy it equally without discrimination, and it represents an added, imperceptible real income, and it is the product of a financial policy inherited from the consumer welfare state for the rentier resource.”

He continued, "It is inconceivable until this moment that 90 percent of Iraq's population is receiving support for food supplies provided by the state as an extension of the economic blockade phase of the 1990s in light of the changing standards of living and lifestyle, the increasing number of affluent people, and the growth of the middle class."

In mid-May, the Iraqi authorities announced the purchase of 1.5 million tons of wheat since the beginning of the year.

According to the Ministry of Agriculture, Iraq, with a population exceeding 43 million people, needs between 4.5 million and five million tons of wheat annually.

The International Monetary Fund said Thursday that Iraq's internal imbalances have been exacerbated by significant fiscal expansion and low oil prices.

The Fund added that Iraq needs to gradually correct public financial conditions in Iraq to achieve debt stability in the medium term and rebuild financial reserves.

To ensure compliance with US standards regarding money laundering and sanctions on Iran, about 20 Iraqi banks were prevented from making dollar transfers.

Last September, the Iraqi government decided that merchants who deal with Iran are forced to turn to the parallel market to obtain currency, given that Tehran is subject to sanctions and “is not allowed to conduct financial transfers,” according to Agence France-Presse.

"A positive step for the "economy" but!!

The Iraqi economic academic, Nabil Al-Marsoumi, believes that the solution to addressing the discrepancy in the currency exchange rate through “free floating of the Iraqi dinar” may have “some economic positives.”

He added in an interview with Al-Hurra website that "the economy should not be taken in its abstract aspect, but rather in terms of its relationship to people, especially the poor among them."

Al-Marsoumi warns that "the Iraqi dinar may witness a violent collapse and rampant inflation that will cause prices in the Iraqi market to rise to record levels that will harm citizens, especially the low-income classes."

He explains that Iraq lacks "a national private sector that could contribute to increasing the supply of dollars in the local market, and because of the large volume of imports, which reach 67 billion dollars annually, the government is the only party that owns the dollar."

He notes that "if the government decides not to intervene in the exchange market, we are expected to witness consequences that will cause severe damage to citizens' living standards, making the poor even more miserable, and may lead to social tensions and a major rift in the social peace."

For his part, the economic expert Al-Obaidi defined the primary goal of liberalizing the currency as “creating an economy capable of withstanding various economic shocks, and reducing reliance on reserves that are greatly depleted in order to maintain a fixed exchange rate, which could stop once the reserves run out.” .

He added that this also "contributes to supporting the domestic product and changing the consumption pattern, and thus reducing the import bill for Iraq, which rises annually as an indirect reason as a result of the attempt to maintain a fixed exchange rate."

Not to mention, “continuing to try to maintain a fixed exchange rate depletes reserves,” which will lead at a certain stage, “accompanied by a decrease in reserves, followed by either a complete liberalization of the currency or a significant reduction in the price rate, which will have major repercussions on the citizen, and will cause great confusion in "A market that already suffers from a lack of economic stability."

"What is the alternative to floating the currency?

The Iraqi economic expert, Mahmoud Dagher, confirms to Al-Hurra website that what may be the solution for Iraq is a system “between floating and stabilization,” to help stabilize currency exchange rates.

The expert, Dagher, a former official at the Central Bank of Iraq, explains that “the origin of the exchange system is floating, which is what free countries adopt.”

He explains that "the continuity of the gap requires reaching a middle system that solves the problem between free floating and stabilization. This is a system that many developing countries follow, and it helps solve the problems of currency fluctuation."

Financial expert Saleh proposes alternatives to floating, in a way that serves the objectives of monetary policy and limits inflationary risks, through the use of financial tools such as “taxes and customs duties that act as an intermediary to influence the exchange rate to achieve balance and price stability.”

He added, "Instead of resorting to lowering the exchange rate to harmonize the market through flotation, it would be through amending customs tariff schedules and imposing careful, thoughtful controls to protect the national economy."