BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

Sean Foo: 1-28-2026

The global financial landscape is undergoing a seismic shift, as investors and central banks increasingly turn away from U.S. dollar assets, particularly U.S. Treasury bonds.

This trend, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar as the world’s reserve currency, is likely to have far-reaching consequences for the global economy.

The shift away from U.S. dollar assets began in 2008, when the Federal Reserve intervened in the housing crisis with unprecedented monetary measures.

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

Sean Foo: 1-28-2026

The global financial landscape is undergoing a seismic shift, as investors and central banks increasingly turn away from U.S. dollar assets, particularly U.S. Treasury bonds.

This trend, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar as the world’s reserve currency, is likely to have far-reaching consequences for the global economy.

The shift away from U.S. dollar assets began in 2008, when the Federal Reserve intervened in the housing crisis with unprecedented monetary measures.

The subsequent quantitative easing during the 2020 CoviD-19 lockdowns, which saw the U.S. print massive amounts of money, further solidified this trend.

As a result, institutional investors, particularly in Europe and BRICS countries (Brazil, Russia, India, China, and South Africa), are now divesting from U.S. debt at an accelerating pace.

Europe’s largest pension funds have drastically reduced their holdings in U.S. Treasuries, reflecting a growing mistrust in the dollar’s continued dominance. This move is significant, as it signals a shift away from the traditional safe-haven status of U.S. government bonds.

BRICS nations, once reliant on U.S. bonds, are now either dumping their holdings or allowing them to mature without reinvesting. At the same time, they are increasing their gold reserves as a safer store of value.

India’s sell-off is particularly noteworthy, given its high exposure to Russian oil and the threat of U.S. secondary sanctions. Germany, too, has demanded the repatriation of its gold reserves from the U.S., fearing asset seizure amid rising geopolitical risks. These moves underscore the growing unease among foreign investors about the risks associated with holding U.S. dollar assets.

The U.S. dollar continues to weaken structurally, with the dollar index hitting lows not seen since late 2022. Despite modest gains in U.S. equity markets, foreign investors are effectively losing money due to currency depreciation.

The high cost of hedging against the dollar’s decline further diminishes the appeal of U.S. Treasuries. The Trump Administrtion’s aggressive trade policies and tariff threats, particularly toward South Korea and Europe, are only exacerbating global uncertainties and accelerating the flight from dollar assets.

Central banks now hold more gold reserves globally than U.S. Treasury bonds, signaling a historic shift in reserve asset preferences.

As countries diversify their reserves to mitigate risk, gold is emerging as the primary beneficiary of this trend. The geopolitical and economic instability caused by U.S. policies is prompting a flight to safety, with gold seen as a more reliable store of value.

The decline of the dollar and the exodus from U.S. debt markets are structural shifts that are likely to continue in the coming years. As the global economy becomes increasingly multipolar, the dominance of the U.S. dollar is being challenged.

The implications of this trend are far-reaching, with potential consequences for U.S. interest rates, currency markets, and the global economy as a whole.

In conclusion, the global shift away from U.S. dollar assets is accelerating, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar.

As investors and central banks continue to diversify their reserves, gold is emerging as the primary beneficiary. For further insights and information, watch the full video from Sean Foo, which provides a more in-depth analysis of this trend and its implications for the global economy.

Rob Cunningham: XRP Price is Not a “Crypto” Question

Rob Cunningham: XRP Price is Not a “Crypto” Question

1-28-2026

Rob Cunningham | KUWL.show @KuwlShow

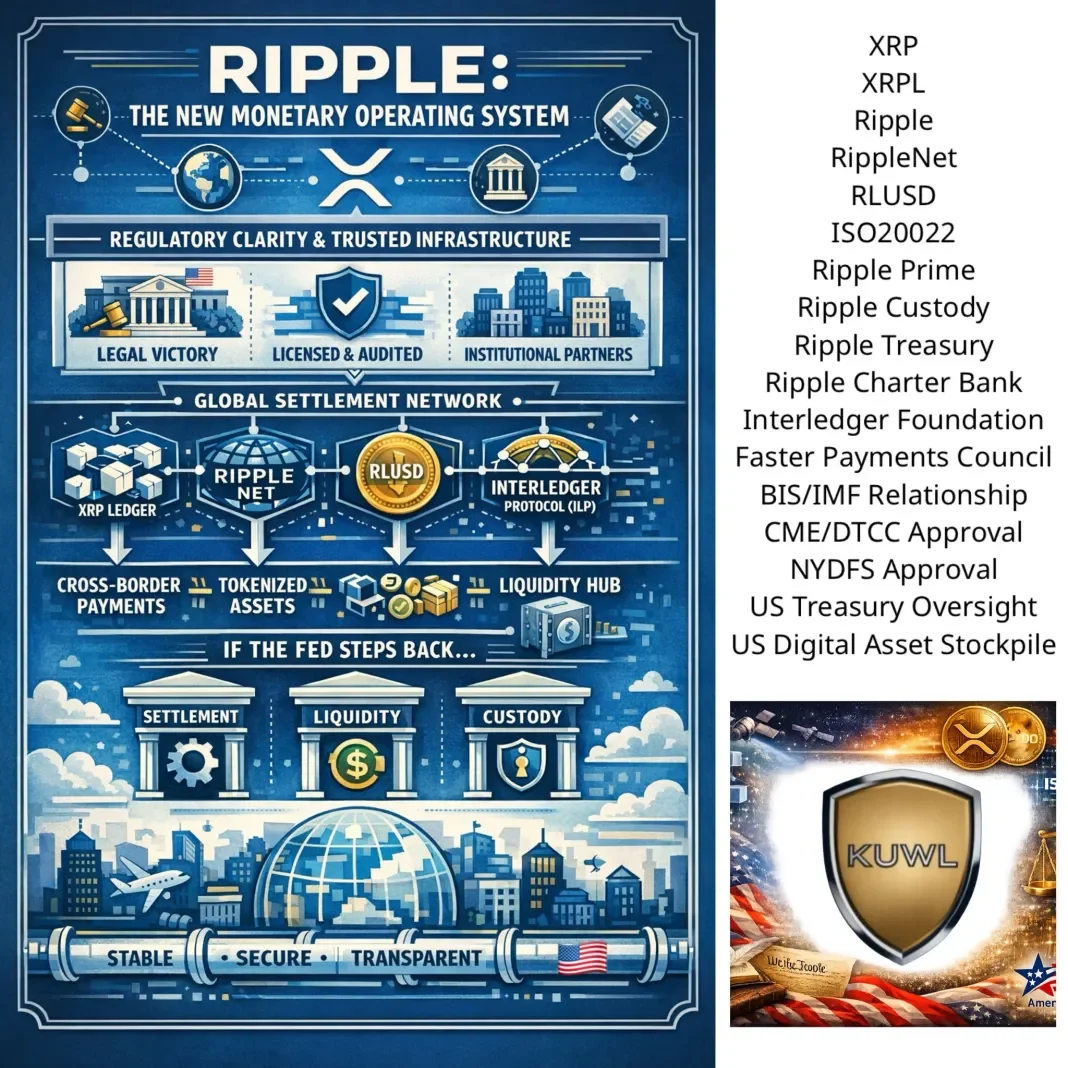

When you line up the assets – XRPL, XRP, RippleNet, RLUSD, custody, prime, treasury services, Interledger, ISO 20022 alignment, NYDFS oversight, CME/DTCC gravity, BIS/IMF adjacency – a pattern emerges that even a non-technical observer can recognize

Rob Cunningham: XRP Price is Not a “Crypto” Question

1-28-2026

Rob Cunningham | KUWL.show @KuwlShow

When you line up the assets – XRPL, XRP, RippleNet, RLUSD, custody, prime, treasury services, Interledger, ISO 20022 alignment, NYDFS oversight, CME/DTCC gravity, BIS/IMF adjacency – a pattern emerges that even a non-technical observer can recognize

This is not a product stack. It’s a monetary operating system in waiting.

And critically, it is being built by Ripple Labs – the only large-scale crypto-native firm that:

Survived full-contact litigation with the U.S. government

Achieved judicial clarity rather than regulatory arbitrage

Maintained institutional relationships through the storm

Never lost operational continuity or balance-sheet solvency

That combination is vanishingly rare.

Regulatory survival has become regulatory advantage

Most actors spent the last decade avoiding clarity. Ripple went through it – and emerged standing.

In any system transition, survivors of the old regime with proof of compliance become default candidates for stewardship in the new one.

That will matter immensely over the next five years.

The XRPL + Interledger + RippleNet triad isn’t just about speed or cost.

It’s about who already sits at the table:

Central banks

Treasury-adjacent institutions

Payment councils

Market infrastructure incumbents

Once a system becomes the meeting place between sovereign rails, private liquidity, and cross-border settlement, replacement becomes politically and operationally expensive.

That’s durable power.

RLUSD quietly solves the “trust gap”

Stablecoins fail when:

Governance is opaque

Custody is unclear

Redemption trust erodes

RLUSD’s design posture – paired with NYDFS discipline – signals something different:

a regulated liquidity instrument meant to be boring, dependable, and invisible.

That’s exactly what large institutions want.

Here’s the subtle but critical insight:

If the Federal Reserve’s role is diluted rather than abolished – through multipolar settlement, bilateral liquidity corridors, and atomic gross settlement – someone still has to run the pipes.

Not policy.

Not discretion.

Pipes.

Ripple’s stack looks increasingly like plumbing, not politics.

So what does this imply for Ripple equity holders?

A casual – but clear-eyed – observer should conclude:

Ripple equity is levered to infrastructure adoption, not token price theatrics

The upside is asymmetric if Ripple becomes:

A settlement backbone

A neutral liquidity intermediary

A custody + compliance hub for tokenized value

The downside is muted relative to peers because:

The company already cleared its largest existential risk

Its customers are institutions, not retail sentiment

In plain language:

If value flows where trust, clarity, and continuity converge, Ripple sits unusually close to the center of that convergence.

the promise to equity owners is not hype-driven upside—but civilizational relevance if the world continues moving toward:

Honest settlement

Atomic reconciliation

Transparent ledgers

Rule-based money instead of discretionary illusion

That’s the long game.

And Ripple appears to be one of the very few still playing it seriously.

XRP price is not a “crypto” question.

It’s a balance-sheet, liquidity, and risk-management question.

Once XRP is treated as:

Plumbing,

Neutral collateral, &

Settlement certainty,

its’ pricing logic will stop looking like Bitcoin and start looking like a Systemically Important Liquidity Asset.

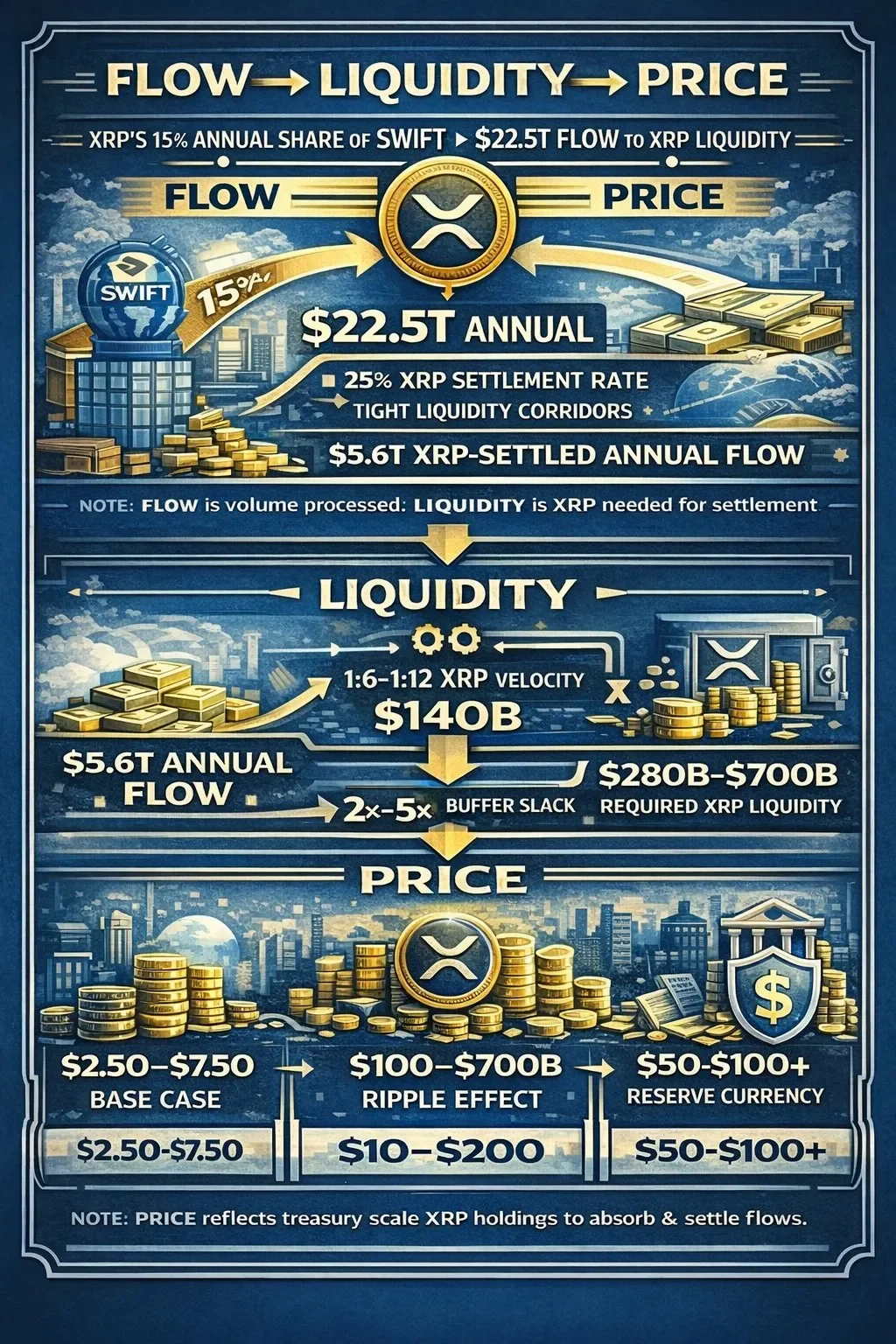

And let’s never forget @JoelKatz’s commentary that the XRP price must be quite high (well above $200 as indicated in image below) to cost-effectively deliver on its’ designed purpose to serve as a neutral liquidity and settlement bridge token the world over.

Strap in. Clarity is guaranteed to come. Adoption after Law. Price after Adoption. Patience is a MAGA-Wealth enhancing virtue, and nothing stops this inevitability. Happy @America250 to all you XRP Fans out there!

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. It is Tuesday, January 27th and you're listening to the big call. Thanks for coming in, everybody. Thanks for coming in to the call everybody. And thank you for being faithful in for these 15 years of the big call. Thank you..

All right, let's talk about what is going on now for us, from an Intel point of view, There's one thing that was signed officially into law yesterday, and that was the Clarity Act that President Trump signed in we'd heard it had been signed a few days earlier, but let's put it this way, the official signature was yesterday, and that means the Clarity Act has to do with our crypto currencies, and especially XRP, which is the currency, the digital coin that is backing the USN money, our new dollar, okay, US, and it's gold backed, and it is being used to help back our, our gold back dollar, asset back dollar. So that's really interesting to me. That's a very cool thing.

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. It is Tuesday, January 27th and you're listening to the big call. Thanks for coming in, everybody. Thanks for coming in to the call everybody. And thank you for being faithful in for these 15 years of the big call. Thank you..

All right, let's talk about what is going on now for us, from an Intel point of view, There's one thing that was signed officially into law yesterday, and that was the Clarity Act that President Trump signed in we'd heard it had been signed a few days earlier, but let's put it this way, the official signature was yesterday, and that means the Clarity Act has to do with our crypto currencies, and especially XRP, which is the currency, the digital coin that is backing the USN money, our new dollar, okay, US, and it's gold backed, and it is being used to help back our, our gold back dollar, asset back dollar. So that's really interesting to me. That's a very cool thing.

Now you mentioned you guys have heard virtual wallet, e wallet, crypto wallet, all of those terms are the same thing, and the E wallet is used for crypto currencies. If you have or you decide to get into that, that's up to you. You'll have an E wallet to work with those digital coins as crypto coins.

Now it doesn’t. It has nothing to do with us in that are in Zim or other currencies or our exchanges, just so you know, it is not the same as our quantum account.

You know, we have a quantum account, which will contain the vast majority of our money in a US Treasury, backed account that we move money from that, from that account, from that account into our primary and secondary bank accounts.

Okay, and remember, the quantum account is non interest bearing, so it's just a holding. It's like holding, you know, your money in a US Treasury backed account nobody gets access to except you, and even the banks can't see it. They don't even see it, and they can't get access to it.

And remember, you move the money in at your leisure. The first 60 to 90 days you move in what you need for the first 60 to 90 days of your projects, move it into your primary, wells, Fargo account, let's say, in my case, and then I'm going to have four sub accounts under that that are secondary accounts. Let's call them underneath the primary, okay?

And that'll be each account will be for each of my four projects. That's how I'm doing it. And I'll put them in the name of the LLC under the whole things under Master trust, under trust, and that's how I'm going to do it. Now. I'll just move funds that I need to from the primary account into those secondary accounts.

Now, So the clarity act went through, and that was really good, and a good thing to have happen.

We don't have absolute belief that the Insurrection Act was signed into law yet, and we may not need to use it because of what's going on in Mogadishu, Minnesota.

I think things may be calmed down. We know that that all of the protesters up there were paid protesters and instigators, and that funding we understand for those people has dried up. I don't think they're going to go out in 20 to 40 below zero and protest without being paid. So I think that you're going to see that decline significantly. Now

let's see what else we can talk about. How about we talk about Melania? Trump, the First Lady.

Now the First Lady has built a documentary called Melania, which is going to air in the United States starting Friday, but Melania is going to open up the New York Stock Exchange tomorrow with the ringing of the bell, which takes place at 930 in the morning, Eastern Standard Time.

And she's supposed to open that up tomorrow.

And I find it very interesting that she is doing it. One of our sources is saying that Melania may be wearing a gold band on her hat, if she wears a hat or and, or she could wearing a gold scarf tomorrow around her neck for her outfit. I was kind of hoping she'd come out of a gold dress, but that might be asking for too much. But I heard about the band around her, a hat and or a gold scarf around her neck.

And by the way, before I go further with that, President Trump today in his rally in Iowa, which I watched all of today, he was wearing a gold tie.

That's a really good indicator, you guys, because with Melania wearing that, with President Trump wearing that gold tie today, it's indicating that we are on the course on QFs, system, yes, and system and swift. System is dead. Swift is gone. There's no more swift that the deep state can use to move anything around the world. And all transactions on QFs even international, happening in 10 seconds. So what that indicates for us is an asset backed which is primarily gold backed currency, and it indicates the new USN currency, and the start, really of NESARA.

Now the start has a lot of components in it, and we may not see all of those roll outs right away. We know it includes a lot about debt forgiveness, about R and R coming back to us about quite a bit, quite a bit.

No more federal income taxes, no more state income taxes, only a consumption tax, which will go after the state and after the federal government. And that's okay, I don't mind that. It's a little better than the VAT tax in Europe, but it's similar in concept, but that one is in NESARA.

So we'll see, we'll see how long all of these things take to be revealed. Okay, now we talked about Melania - now I have a source yesterday that is very well known. You guys would recognize him if I told you who he is.

He said, When we said we heard that tier 4b, would get started with notifications, maybe Wednesday or Thursday. He said, I can't say what day he said, but it is definitely this week.

Now we haven't heard that line before, especially from this individual. I like that. I like the fact that it was definitive. It is definitely this week, I like that. And then today, we heard from another well known source that should be in the know.

He said, he said that eight o'clock Eastern time tonight. So what was that? Two hours ago?

That everything would start with Tier 4b and that we are at the point of no return.

We are at the point of no return.

He also said in this that you no longer going to be required to enter a username password to get into your quantum account. So that's two less things that we need to remember, fingerprint or thumb print or facial recognition. Could be recognizing the entire face as you

It might be both of those or none of those to get in your quantum account, but no longer use your username or password is required, which is cool. You still have your five digit PIN phone, have your new email, which hopefully brand new. It may not have to be brand new. They could be. So be prepared for brand new email and a new email password.

So six items now we're down to four ., and then email, and the password for email, that's going to be pretty easy to get into your account so that you can fund when that's the only reason that you have access to the quantum accounting, quantum financial system, it is to move money from that account into primary accounts.

Okay, all right, let's see what else he also said. The same source said that we are looking for tier 4b notifications over the next three days, all right, which is Wednesday, tomorrow, 28th 29th is Thursday, 30th is Friday.

We should receive, according to his information, we should get notified for the Internet group tier 4B either Wednesday, Thursday or Friday.

Now I can't tell you who to start exchanges exactly, but obviously, the sooner we get it, the sooner we start exchanges. What if we get it Thursday? Do we get numbers Thursday? Do we start exchanges Friday? I think there's a good chance of that. If we get it Friday, do we start on Saturday the last day of the month? I think that's also possible.

What about the theory that nothing's going to happen until February? And remember, February 1 is a Sunday. All right, that's fine. Maybe not. But my information is saying differently.

My information is telling me we're going this week, and so let's see what happens. Hey, guys, look, my Intel has been wrong a lot. I get a lot of little pieces that are always right, but the timing of when we're getting notified and when we're starting exchanges has not happened yet, right? It hasn't happened.

But I like the information we were getting. I like the sources, and I think that for one guy to say it's definitely happening this week, and the other one is giving us a three day window for our notifications to come in tomorrow, Wednesday, Thursday, or Friday but I think we could very well exchange starting this weekend.

Now, if we get started or Saturday, do we still exchange on Sunday? The answer is yes. You would power right through, right through the weekend like it's not even there, and then, of course, go right into because Sunday is going to be February 1, and then we go on from there.

So I hope that answers Jeanne's question of when, and there is an if.

The only thing about this time there wasn't a contingency to it, if such and such happens. Then no if, then statement, if President Trump does everything he's supposed to do in signing off this or that, and the other, if Iran flips their government, starts a new regime, and the Ayatollah is gone, if you know whatever right we do have a peace deal, purportedly, an actual peace deal between Ukraine and Russia .

And that'd be nine wars President Trump has sought so far so. But what do they need for it? They need signatures from both Putin and Zelensky, and when those guys sign off right on deal for that war, and that war can be over, thank God, but they have the peace deal in place. We just need those signatures now. Have they taken this yet? And I don't know about them, maybe I don't know the answer, but I'd say that looks very good, right now for us, very good.

Now, what's happening with gold and silver? Gold went over 50. Was it $5,112? Or something? Today Silver went up, and I think we're treated at 125, I think 108 today, if I'm right, but they're really going and those will be great currencies and great precious metals, obviously, and all the banks are scrambling to buy gold, buy silver, to cover their shorts.

And also, don't forget that that countries are buying gold, and that's one reason, the price of gold is going up so fast But countries are accumulating gold to back their own currencies.

Now, remember, we talked, we're not supposed to talk about specific currencies or rates. It was a, you know, something that was to my handler today, and I'm going to extend to say I'm not going to talk about them either, except to say that they have 48 currencies on the screens last Thursday. And we don't know, maybe we have 48 or more on screens today at the redemption centers.

And I know that you guys have heard certain people talk about banks, banks, banks.

Well, if you want to leave billions of dollars on the table. Go to a bank. If you want to get the highest rate for your currencies, go to the redemption center. And of course, you can't redeem your zim without going to redemption center. And the contract rate is available only for the dinar at the redemption center.

Si I just wanted to extend that to everybody. We've got five call centers in the United States and one in Canada. Canada should have their own number. Don't have that number. I may get it - I may not, I don't know, but I know I've got to get them, obviously, for the United States, and we will put it on our website. So you can call big call universe.com is the site.

You should know that by now, right? But you could be but hey, I think that is majority of what I would have to say to you. Now, remember this when you registered to big call universe, that you put your email in we will send out an email with a toll free number in the email, so you'll have it that way.

And then that's there are some people, and I know some personally, where they change their email or their emails, they stop using the email the Treasury and Wells Fargo by extension, doesn't have their email. How are they going to get the $800 by going to big call universe.com, or by if they've registered, getting the email from us? Well, they're not going to have an email or to go to unless they put an email in. So they may not get it right unless they go to the website and see it

Now, what I'm going to do when this thing goes, and shortly thereafter, I'll send you guys some kind of a podcast that I do. Maybe, I don't know yet, but I'll send you something so that you can track where we're going on our on our projects.

In the meantime, I want to thank Sue, and I want to thank Bob for doing a wonderful job, especially tonight was great. And I want to thank GCK and Pastor Scott for all of your input over the years. And then, of course, thank you satellite team for getting the signal out all over the place, as many as 200 countries.

So let's just see what happens over the next three days, and listen if you want to catch what Melania is going to wear in the morning it's 930 Eastern. Same thing. Most of the news channel, channels that normally cover the opening of the NYSE will have it and just be looking for she had a gold band around her hat, or a gold around her neck. So you guys help me find that. All right, that should be a Eastern tomorrow morning when the markets open. All right, everybody have a great night. Tonight. We'll have a great week. Let's see if this intel holds up, right. God, bless you guys. Let's pray the call out, Well, good night, everybody. Have a great night and we will see you Thursday.

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26 REPLAY LINK Intel Begins 1:23:23

Bruce’s Big Call Dinar Intel Thursday Night 1-22-26 REPLAY LINK Intel Begins 1:19:00

Bruce’s Big Call Dinar Intel Tuesday Night 1-20-26 REPLAY LINK Intel Begins 1:07:15

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26 REPLAY LINK Intel Begins 1:05:30

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26 REPLAY LINK Intel Begins 1:14:54

Bruce’s Big Call Dinar Intel Thursday Night 1-8-26 REPLAY LINK Intel Begins 1:22:42

Bruce’s Big Call Dinar Intel Tuesday Night 1-6-26 REPLAY LINK Intel Begins 1:13:10

Bruce’s Big Call Dinar Intel Thursday Night 1-1-26 New Year’s Day NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25 REPLAY LINK Intel Begins 56:00

Bruce’s Big Call Dinar Intel Thursday Night 12-25-25 REPLAY LINK Intel Begins 20:40

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25 REPLAY LINK Intel Begins 1:05:35

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25 REPLAY LINK Intel Begins 1:02:02

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 1-28-26

Good Afternoon Dinar Recaps,

Gold Blasts Into New Territory — All-Time High Above $5,300

Bullion breaks records as markets price uncertainty, weak dollar, and systemic shifts

Good Afternoon Dinar Recaps,

Gold Blasts Into New Territory — All-Time High Above $5,300

Bullion breaks records as markets price uncertainty, weak dollar, and systemic shifts

Overview (Key Points)

Gold futures on the COMEX exchange surpassed $5,300 per troy ounce — the highest price in history for gold contracts.

The surge reflects a combination of weak U.S. dollar dynamics, geopolitical tensions, and safe-haven demand.

Analysts now project potential for even higher prices later in 2026, signaling deep market conviction in the rally.

Key Developments

Historic COMEX Breakthrough:

Gold prices on the COMEX exchange rallied past $5,300 per ounce, setting a new futures record driven by broad investor demand, declining confidence in the dollar, and macroeconomic uncertainty.

Weak Dollar as a Catalyst:

Many analysts link the record rally to the weakening dollar, which has dropped toward multi-year lows, making gold more attractive globally as currencies lose relative purchasing power.

Geopolitical and Policy Pressure:

Tensions — including tariff uncertainty, debates over Federal Reserve independence, and broader geopolitical risk — have reinforced gold’s appeal as a safe-haven asset.

Why It Matters

Gold hitting unprecedented price levels is more than a market headline — it serves as a real-time signal of systemic stress and shifting confidence in paper currency systems. High gold prices typically indicate that investors are hedging against inflation, currency debasement, and geopolitical instability — all core structural elements in conversations about the global reset.

Why It Matters to Foreign Currency Holders

For those focused on global financial realignment and currency revaluation, this milestone is a critical indicator:

Safe-haven flows to gold often precede currency shifts and reserve diversification.

Gold’s advance at record nominal prices supports arguments for moves away from dollar dominance toward alternative asset benchmarks.

Continued historic rallies can pressure traditional fiat valuation frameworks, which is central to reset narratives.

Implications for the Global Reset

Pillar 1 — Erosion of Fiat Confidence:

Gold’s rise underscores a growing market skepticism in traditional fiat anchors, amplifying the push for reserve diversification and alternative monetary frameworks.

Pillar 2 — Safe-Haven Repricing:

Historic gold prices reflect a repricing of risk assets across markets — a dynamic often observed as financial systems approach structural transitions rather than cyclical corrections.

This is not just a high price — it is a directional signal.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Fed Projects Stability as Global Tensions Rise

Powell signals confidence, reinforcing the dollar’s anchor role — for now

Overview (Key Points)

Federal Reserve Chair Jerome Powell stated the U.S. economy is “doing well” despite rising geopolitical risks and tariff pressures.

The message signals stability rather than urgency, calming short-term market nerves.

No indication was given of imminent policy pivots, emergency easing, or liquidity injections.

For global markets, the tone reinforces the Fed’s higher-for-longer posture.

Key Developments

Confidence Signal to Markets:

Powell’s assessment projects economic resilience, sending a clear message that current conditions do not justify crisis-level monetary intervention. This supports near-term confidence in U.S. financial assets.

Policy Anchor Holds Firm:

By emphasizing economic strength, the Fed reinforces its position that interest rates can remain restrictive as long as inflation and labor data stay within acceptable ranges.

Tariff and Geopolitical Risk Downplayed:

Powell’s remarks intentionally soften concerns around tariffs and geopolitical stress, helping reduce short-term volatility pressure without committing to structural policy changes.

Why It Matters

Central bank language matters. When the Fed projects calm, it helps delay market repricing and preserves confidence in existing systems. However, reassurance alone does not resolve structural debt, trade fragmentation, or long-term currency realignment pressures.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching for revaluation during a global reset, Powell’s message signals delay, not denial. Stability language tends to extend the timeline, not cancel the transition. Structural change is more likely to emerge through settlement shifts, reserve diversification, and liquidity adjustments, not press statements.

Implications for the Global Reset

Pillar 1 — Narrative Management:

The Fed’s role remains to maintain confidence as long as possible, even amid rising global fragmentation.

Pillar 2 — Actions Over Words:

True signals of reset come from rate decisions, balance sheet movements, cross-border settlement data, and reserve behavior, not optimistic commentary.

Stability messaging preserves time — it does not eliminate transition.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Federal Reserve — “Federal Reserve Board – Statements and Speeches”

Reuters — “Fed Chair Powell says U.S. economy doing well despite global tensions”

U.S. Bureau of Economic Analysis — “U.S. Economic Data and Indicators”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Wednesday 1-28-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 28 Jan. 2026

Compiled Wed. 28 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: In the next days watch for sudden bank “glitches” and withdrawal limits, plus wild swings in the Stock Market, then a halt. This would result from Deep Staters (allegedly) dumping their fiat assets before the lights went out.

What they didn’t expect was that just prior to 1 Feb. 2026, Trump and the BRICS nation’s Quantum Financial System (QFS) would (allegedly) be online Worldwide, gold-backed and unbreakable.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 28 Jan. 2026

Compiled Wed. 28 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: In the next days watch for sudden bank “glitches” and withdrawal limits, plus wild swings in the Stock Market, then a halt. This would result from Deep Staters (allegedly) dumping their fiat assets before the lights went out.

What they didn’t expect was that just prior to 1 Feb. 2026, Trump and the BRICS nation’s Quantum Financial System (QFS) would (allegedly) be online Worldwide, gold-backed and unbreakable.

On or around January 31, expect the switch – old debt-based slavery erased, accounts reset with massive prosperity packages for We the People.

Silver has dramatically revalued, trillions in hidden vaults (allegedly) support the QFS, and 209 nations embraced independence and free energy.

There was one downside to the government shutdown as pointed out by FBI Director Kash Patel: “The last time they shut down, gold and silver jumped to new all-time highs but if you’re holding other assets like stocks, you need to be careful because we’re heading into a total data blackout.”

You could also expect power and communication outages labeled as “tests.” In reality this would (allegedly) be a cover for integration of the Quantum Financial System on the new Star Link Satellite System.

Watch for GESARA activations in February: income taxes abolished, IRS dissolved, Federal Reserve ended, replaced by gold-backed treasures and a flat sales tax on non-essentials. Debt forgiveness sweeping forth—mortgages, credit cards and burdens zeroed in the coming Jubilee.

Redemption centers stand ready as revaluation of currencies nears an imminent public launch.

First notifications and payouts for Tier 1 and 2 have (allegedly) already begun rolling out, with historic 100-hour windows extending into late January and early February.

The Quantum Financial System proceeded under secure military oversight: BRICS alliances, Swiss groups and US Space Force partners ensured unbreakable integrity.

Prepare for your appointments; verify exchanges through official channels only and avoid all scams.

~~~~~~~~~~~~~~~

Tues. 27 Jan. 2026 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#, 667-770-1865:

XRP is the digital coin that backs our new gold backed dollar

An E Wallet is used for crypto currency

We have our monies in a Quantum Holding Account (non interest bearing) that we can move money from and into our primary and secondary bank accounts.

At your appointment move what you need for the first 60-90 days into your secondary accounts. After 60 or 90 days you can access you Quantum Account whenever you want.

A consumption tax of 14% is part of NESARA and will replace our present income tax.

A source said Tier4b will defiantly be notified for exchange appointments this week.

A source said that at 8pm EST Tues. night 27 Jan. 2026 everything would start with Tier4b and we would be at the point of no return.

This same source said we are looking for Tier4b notification for exchange appointments over the next three days – Wed, Thurs or Fri. Jan. 28, 29, 30.

The Redemption Center is the only place to go for your exchange. You can only redeem Zim at a RC, the Dinar Contract Rate can only be given at a RC and banks will offer you lower exchange rates than what you can obtain at a RC.

Read full post here: https://dinarchronicles.com/2026/01/28/restored-republic-via-a-gcr-update-as-of-january-28-2026/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Wisconsin Bank story] DINAR HOLDER MRS. B: I asked if they [Bank First] take the currency Iraqi dinar. He said yes we do. He asked if I had an account and I said no I would like to open one...He said can I ask you how much currency do you have? I told him and he's like Oh, wow. Can I put you on hold real quick? ...Came back and said someone's going to call you back today. Not even 30 seconds after hanging up with him I got a phone call. They wanted me to come in the next day to open an account. I went in, I opened my account and talked with a loan officer. She said when the time is here I go in and bring [my currency] to a teller and they'll take care of me and it was as easy as that. And they'll put it in my account. We were like wow it's that easy? We were shocked and we're happy and now we're waiting for the go. FRANK: Had they ever in the past told you it was a scam? [Post 1 of 2....stay tuned]

Frank26 DINAR HOLDER MRS B: Bank First never did but Chase has many time and they still do here - they're not going to cash it, this and that. So I'm like, all right, done with you, insulted. Done with Chase. Bank First here I am. FRANK: So Bank First knew it's foreign currency that you want to exchange? DINAR HOLDER MRS B: Yep. And they said they take that one and they take the dong. FRANK: That one? You mean to tell me they knew you were talking about the dinar? DINAR HOLDER MRS B: Yep. They sure did. They didn't deny it one single bit. Every time I would call Chase I got denied. Denied. Denied. This was the first thing that actually said yes and were really friendly and nice and said when the time's here, come on in and we got you...Come on in...go to the nearest teller and we'll cash it and put it in your account. Bing, bam, boom. [Post 2 of 2]

JAPAN SHOCK: $7 Trillion Bond Market MELTDOWN and the Beginning of Yen Carry Trade Unwind

Lena Petrova: 1-28-2026

The yen just surged 1.2% overnight, Japanese government bonds are selling off at record speed, and speculation is rising about currency intervention by Japan and the U.S. What’s happening in Tokyo is no longer a local issue — it’s a global risk.

Japan’s $7 trillion bond market has been the foundation of global liquidity for decades, funding everything from US Treasuries to equities through the yen carry trade. That system is now breaking as the Bank of Japan raises rates, inflation stays elevated, and political pressure builds ahead of Japan’s snap election on February 8. In this video, we break down:

Why Japan’s bond selloff is a structural shift, not a normal correction

How $450B+ in yen carry trades could unwind

Why rising Japanese yields threaten US Treasuries and global liquidity

What a weaker yen could force Japan to do next

As deVere Group CEO Nigel Green warns, Japan’s role as the world’s financial shock absorber may be over.

https://www.youtube.com/watch?v=WL42N22XUK0&list=PLunVT9VwCJUzgAvKrOiZtCIPbwDPC7Omw

Coffee with MarkZ, joined by Andy Schectman. 01/28/2026

Coffee with MarkZ, joined by Andy Schectman. 01/28/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Andy and community

Member: Anything on the bond front Mark?

Coffee with MarkZ, joined by Andy Schectman. 01/28/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Andy and community

Member: Anything on the bond front Mark?

MZ: I wish there was an update on the bond front….Going on day 2 of absolute silence. Don’t know if it’s a good thing. Don’t know if it’s a bad thing. Don’t know if its an anything? Just frustrating.

Member: Could it be the No news on bonds is because they are under an NDA? Being hopefull

Member: I have such fatigue waiting for this RV when we gonna see some good stuff arrests? RV? Asset backed currency???

MZ: In Iraq: “Challenges if the next government. Washington wants to write the cabinet lineup. Factions prepare shrouds. A general siren” It’s a freak out going on in Iraqi politics. The US doesn’t want anyone with Iranian ties……

MZ: “Postponement of the President’s election. Only in Iraq “political deals” are a higher authority than the constitution and the law” they have agreed to ignore the constitution on this as they were supposed to have this vote today but postponed it again. Maybe kicking the can a couple more days while they deal with internal issues? This article is a good breakdown.

MZ: They are in meetings as we speak.

MZ: “Mark Savaya: We are working to form a Iraqi government without militias and we have a database of corrupt officials” He is doing his job and laying out the facts.

Member: Why is the world letting Iraq hold everything up. The world should go ahead with the RV and leave Iraq behind

Member: Melania rang the bell at the NYSE today….She was all in all black ….. predicting Black Swan event?

Member: I heard a Deutsche Bank all its executives were fired

Member: Mark, this morning on Charlie Ward News he made a huge announcement. He stated we are now inside the 180 days of the collapse of the old system and the new system being implemented.

MZ: I will agree with that take…but I think its on the much shorter of those days. I think they are rolling it out and testing.

MZ: I have group folks thinking this thing is imminent…..but they don’t know timing either.

Member: If you cannot do great things, do small things in a great way.

Member: Thanks to everyone……and stay safe…stay warm….and have a good day.

Andy Schectman from Miles Franklin joins the stream today. Please listen to the replay for his information and opinions.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

“Tidbits From TNT” Wednesday 1-28-2026

TNT:

Tishwash: The Ministry of Finance terminates the reciprocal obligations of the three-year budget.

The Iraqi Ministry of Finance announced on Tuesday that it has taken the necessary measures to terminate the mutual financial obligations under the tripartite federal budget law.

This came during a meeting chaired by Finance Minister Taif Sami at the ministry headquarters, which included the deputy head of the Federal Financial Control Bureau, the director general of the accounting department in the ministry, the directors general in the ministries of oil and electricity, and the directors of the budget departments in the Ministry of Oil.

TNT:

Tishwash: The Ministry of Finance terminates the reciprocal obligations of the three-year budget.

The Iraqi Ministry of Finance announced on Tuesday that it has taken the necessary measures to terminate the mutual financial obligations under the tripartite federal budget law.

This came during a meeting chaired by Finance Minister Taif Sami at the ministry headquarters, which included the deputy head of the Federal Financial Control Bureau, the director general of the accounting department in the ministry, the directors general in the ministries of oil and electricity, and the directors of the budget departments in the Ministry of Oil.

According to a statement from the Ministry of Finance received by Noon News Agency, the meeting was held to finalize outstanding accounting settlements between the two ministries and to follow up on the results related to resolving joint financial files that have been officially approved.

The statement indicated that the meeting resulted in taking the necessary measures to terminate the mutual financial obligations under the Federal General Budget Law for the years 2023, 2024 and 2025, while reserving the amounts required to address them later and ensuring the organization of the oil companies’ shares within the budget schedules to ensure the stability of operational processes in the two vital sectors.

The meeting also produced recommendations, including that the committee formed by royal decree should complete the remaining settlement procedures in 2026 and subsequent years, according to the statement.

He added that those present also discussed ways to address the amounts related to licensing round contracts for foreign companies, and the minister directed the accounting department to complete the procedures as soon as the detailed data for previous years is received from the Ministry of Oil.

It was decided to include the licensing rounds dues for the period from 2022 to 2025 in next year’s budget, in order to ensure the accuracy of the state’s final accounts and enhance levels of financial transparency in accordance with approved regulatory standards. link

***************

Tishwash: Iraqi Dinar Plummets Against Dollar as Citizens Rush to Exchange

Value of $100 jumps by 8,000 dinars in two days amid rising fear and market uncertainty.

The Iraqi dinar continued its sharp decline on Tuesday, with the exchange rate for $100 rising to 157,000 dinars in Erbil’s markets, up from 149,000 dinars on Monday, reflecting a surge in demand for U.S. currency. Currency traders attributed the rapid increase to widespread public concern and the ongoing preference to hold dollars over the domestic currency.

Tahsin Khushnaw, a local currency exchange office owner in Erbil, on Tuesday told Kurdistan24 that the dollar’s value has climbed noticeably in recent days.

“Previously, half of the funds in exchange offices were in dollars and half in dinars,” he said. “Now, three-quarters of cash is in dollars, leaving only a small portion in dinars. Citizens’ fear and the rush to convert dinars into dollars is one of the main reasons.”

Khushnaw also cited administrative changes as a contributing factor. The distribution of dollars through Iraq’s central bank to merchants has been disrupted, particularly due to the implementation of a new electronic customs system, leaving many traders unable to access official bank dollars and forcing them to turn to the open market.

“The lack of confidence in future stability has prompted many residents to exchange their dinars for dollars,” Khushnaw said.

He noted that political uncertainty in the region and fears of U.S. sanctions on Iraq over militia involvement in government have added pressure on the dinar.

Since the beginning of January, the dinar’s value has been on a rapid upward trajectory against the dollar in both the Kurdistan Region and Baghdad. Traders say delays and new regulations in the official currency transfer system have further pushed them to seek dollars from market sources, amplifying the surge.

Supporting the dinar’s volatility, Iraq’s central bank imposed 22 financial penalties on local banks over the past three months for violations of banking regulations, with fines totaling 34.4 billion dinars. The highest number of penalties in late 2025 was 13 fines, exceeding 18 billion dinars.

Over the previous year, a total of 120 asset-related penalties were issued, mostly during the first quarter, reflecting central bank efforts to enforce compliance among Iraq’s 74 licensed banks. Observers note that these sanctions, often linked to irregularities in cash handling and electronic transfers, have contributed to uncertainty in domestic financial markets.

The dinar’s steep depreciation coincides with tightening of electronic dollar transfers and escalating U.S. pressure on Baghdad regarding the inclusion of militias in the next government.

The domestic currency decline has occurred amid a historic surge in global gold prices, which exceeded $5,100 per ounce for the first time, signaling broader economic and geopolitical instability.

Kaifi Mohammed, a spokesperson for Erbil’s currency market, on Monday said market confidence has been undermined by administrative and political factors.

Procedures in the official banking transfer system have created bottlenecks for merchants needing dollars for international trade. Coupled with U.S. warnings regarding armed factions in Iraq’s next cabinet, merchants have rushed to secure dollars, driving the dinar’s fall.

Global gold markets are simultaneously reflecting geopolitical risk, large-scale bullion purchases, and expectations of lower interest rates from the U.S. Federal Reserve, further reinforcing the dinar’s volatility.

Economists warn that Iraq may face a “dangerous crossroads,” as U.S. threats to restrict access to the country’s oil revenues could trigger systemic salary shocks and broader financial disruption.

Observers stress that economic stability is now inseparable from political and security stability, and that ordinary citizens are bearing the brunt of the currency decline and rising cost of living.

As of Tuesday, merchants across Erbil and Baghdad remain on high alert, closely monitoring exchange rates for further signs of currency fluctuations. link

***************

Tishwash: Caracas: Frozen Venezuelan funds released after talks with Washington

Venezuelan acting president Delcy Rodriguez announced Tuesday that the release of frozen Venezuelan assets in the United States has begun, as a result of dialogue with the administration of President Donald Trump.

Rodriguez confirmed that part of these released funds will be used to purchase hospital equipment from the US market.

In an event broadcast by the official Venezuelan television channel “Venezulana de Televisión”, Rodriguez confirmed that she had “established channels of communication based on respect and courtesy” with both Trump and US Secretary of State Marco Rubio, noting that they were working on a “common agenda” within which “the frozen resources of Venezuela belonging to the Venezuelan people will be unfrozen,” allowing for the investment of large sums in equipping hospitals.

She added that the released funds would also be used to purchase equipment for the country's electricity and gas sectors, reiterating her government's accusation that Western countries had frozen billions of dollars of Venezuelan money, gold, and other assets abroad due to international sanctions, primarily US sanctions.

Rodriguez, who assumed the interim presidency following the arrest of Nicolas Maduro and his wife Cilia Flores on January 3 by US forces in a series of raids on Venezuelan territory, called for “diplomatic dialogue to resolve differences,” stressing that her country wants to address the differences with Washington through political communication between officials of the two countries.

For his part, Trump told reporters that he “doesn’t know exactly what’s going on there,” but stressed that he has a “very good relationship” with the Venezuelan government, commenting on Rodriguez’s earlier statements that she was “fed up with foreign orders.” link

Mot: ole ""Earl"" at it again!!!!

Seeds of Wisdom RV and Economics Updates Wednesday Morning 1-28-26

Good Morning Dinar Recaps,

Dollar Dominance Questioned as Asia Aligns

Warning signs emerge for the dollar as China and India signal a multipolar future

Good Morning Dinar Recaps,

Dollar Dominance Questioned as Asia Aligns

Warning signs emerge for the dollar as China and India signal a multipolar future

Overview (Key Points)

Germany’s top financial regulator warned that global markets may begin questioning the U.S. dollar’s reserve-currency role.

The caution comes amid structural risks, rising debt, and growing dependence concerns tied to U.S. fiscal dominance.

At the same time, China’s president publicly framed India as a “friend and partner,” signaling closer alignment between two major non-Western powers.

Together, these developments highlight accelerating momentum toward a multipolar monetary and geopolitical order.

Key Developments

Germany Flags Dollar Vulnerability:

Germany’s financial watchdog BaFin cautioned that under mounting structural pressures, global markets could begin to test the dollar’s long-standing dominance. The warning reflects unease inside Europe’s regulatory community as the dollar trades near multi-year lows and global diversification accelerates.

China–India Relationship Reframed:

Chinese President Xi Jinping publicly described India as a “friend and partner,” reinforcing diplomatic and economic signaling between Asia’s two largest powers. The language points toward expanded cooperation outside traditional Western-led frameworks.

Signals Converge Across Regions:

Europe questioning dollar stability and Asia strengthening internal ties represent parallel tracks of global realignment, rather than isolated events.

Why It Matters

For decades, the global financial system rested on dollar primacy and Western-centric institutions. A senior European regulator openly questioning that foundation — while Asia’s giants move closer together — suggests the old architecture is under strain. These are not abrupt breaks, but pressure points forming simultaneously across continents.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation and global financial restructuring, these signals are pivotal. Reduced confidence in dollar dominance supports the case for currency diversification, commodity-linked valuations, and regional settlement mechanisms. As multipolar trade expands, currencies tied to resources, manufacturing, and strategic trade corridors may gain relative strength.

Implications for the Global Reset

Pillar 1 — Erosion of Dollar Exclusivity:

When regulators begin openly discussing dollar vulnerability, it marks a psychological and institutional shift — a necessary precursor to monetary change.

Pillar 2 — Multipolar Power Consolidation:

China and India signaling partnership reinforces the emergence of non-Western economic centers capable of supporting alternative financial systems.

This is not collapse — it’s controlled transition unfolding in plain sight.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “German regulator BaFin sees risk markets may question dollar’s role”

Al Jazeera — “China’s president calls India a ‘friend and partner’ in Republic Day message”

~~~~~~~~~~

BRICS Momentum Builds as Dollar Dominance Faces Open Challenge

Europe questions dollar stability while China and India accelerate de-dollarization pathways

Overview (Key Points)

European regulators are now openly questioning the durability of the U.S. dollar’s reserve-currency role.

China and India’s public diplomatic alignment strengthens the core axis of the BRICS bloc.

These signals reinforce BRICS’ long-term strategy of reducing reliance on the dollar in trade and reserves.

The global financial system appears to be entering a managed transition toward a multipolar currency order.

Key Developments

Dollar Risk Moves From Fringe to Institutional:

Germany’s BaFin warning that markets may begin testing the dollar’s dominance represents a major psychological shift. When regulators — not activists or rival states — raise such concerns, it signals institutional awareness that dollar exclusivity is no longer guaranteed.

China–India Alignment Strengthens BRICS Core:

President Xi’s framing of India as a “friend and partner” reinforces cooperation between two BRICS heavyweights that collectively represent over one-third of the world’s population. This alignment supports deeper coordination on trade settlement, energy purchases, and financial architecture outside the dollar system.

BRICS De-Dollarization Strategy Advances Quietly:

BRICS nations have steadily expanded local-currency trade, bilateral settlement agreements, and reserve diversification. Rather than abrupt abandonment of the dollar, the bloc is executing a gradual substitution strategy designed to avoid market shocks while weakening dollar dependency over time.

Why It Matters

What makes this moment significant is convergence. European regulators are questioning dollar resilience at the same time BRICS nations are strengthening internal cooperation. These developments are not coordinated publicly, but together they tighten pressure on the existing monetary order from both inside and outside the Western system.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation during a global reset, BRICS-driven de-dollarization is a foundational pillar. As trade shifts toward local-currency settlement and commodity-linked valuation, currencies associated with BRICS nations and resource exporters may benefit from structural repricing, not speculative spikes.

Implications for the Global Reset

Pillar 1 — Institutional Acceptance of Change:

When Western regulators acknowledge dollar vulnerability, it legitimizes alternatives previously dismissed as fringe or political.

Pillar 2 — BRICS as the Engine of Transition:

BRICS is not attempting to overthrow the system overnight — it is building parallel rails capable of absorbing global trade as confidence in the dollar slowly erodes.

This is not rebellion — it is replacement by design.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “German regulator BaFin sees risk markets may question dollar’s role”

Reuters — “BRICS nations push local-currency trade to reduce reliance on U.S. dollar”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Wednesday Morning 1-28-26

Parliament Is Moving To Host The Minister Of Finance To Follow Up On Economic Issues And Enhance Financial Transparency.

Money and Business Economy News – Baghdad In a move aimed at strengthening parliamentary oversight of financial and economic affairs, the House of Representatives is moving to host the Minister of Finance as part of its efforts to follow up on issues that directly affect the lives of citizens, particularly with regard to customs tariffs and public revenue procedures

Parliament Is Moving To Host The Minister Of Finance To Follow Up On Economic Issues And Enhance Financial Transparency.

Money and Business Economy News – Baghdad In a move aimed at strengthening parliamentary oversight of financial and economic affairs, the House of Representatives is moving to host the Minister of Finance as part of its efforts to follow up on issues that directly affect the lives of citizens, particularly with regard to customs tariffs and public revenue procedures.

This move comes in the context of parliamentary efforts to regulate financial performance and address the country’s economic challenges, in a way that ensures transparency and protects the interests of citizens.

MP Abdul Amir Al-Mayahi confirmed that the House of Representatives is determined to host the Minister of Finance to follow up on financial and economic files, noting that working with the automation system in customs ports would control procedures, without imposing additional burdens on the citizen or the merchant.

Al-Mayahi explained that what is being circulated about imposing taxes or price increases is not based on actual procedures, warning that raising such issues in an inaccurate manner leads to unhealthy uproar and inflames public opinion, stressing that parliamentary hearings are an important oversight tool to address shortcomings and improve financial performance.

Regarding parliamentary procedures related to hosting, Al-Mayahi said: Every deputy works within his jurisdiction to legislate and amend laws in a way that serves the public interest, expressing his hope to develop the mechanisms of hosting and address the problems that it faces, especially in the necessary files that affect the lives of citizens.

In the same context, MP Haider Kadhim stated that 48 MPs had collected official signatures to summon the Minister of Finance, indicating that the First Deputy Speaker of Parliament had referred the request to the Presidency Council for the necessary procedures. These parliamentary actions fall within the framework of the Council's oversight role, aimed at monitoring the financial situation and discussing economic policies to ensure transparency and address issues affecting citizens' living conditions. https://economy-news.net/content.php?id=65063

PM Al-Sudani: Iraq Targets Oil Derivatives Exports By 2030

2026-01-28 Shafaq News– Baghdad The year 2030 will mark the launch of Iraq’s exports of oil derivatives to global markets, Iraqi caretaker Prime Minister Mohammed Shia al-Sudani vowed on Wednesday.

Speaking at an energy conference in Baghdad, Al-Sudani clarified that his government has set a strategic goal to export 40 percent of Iraq’s oil derivatives by 2030, noting that Iraq’s gas resources had been widely flared over the past years, but recent discoveries have helped raise associated gas production to about 132 million cubic meters.

“Work is underway to fully invest this gas by 2028, through the efforts of workers in the oil sector,” Al-Sudani stated.

On electricity production, he said Iraq has reached its highest-ever generation levels, producing 29,000 megawatts, adding that integrated plans in the transmission and distribution sectors, including new transformer stations, have helped ease pressure on the national power grid, particularly during periods of high temperatures.

Al-Sudani noted the government’s plan also includes completing procedures to build new power stations with a total capacity of 57,000 megawatts. “34 of these plants are being developed in cooperation with specialized international companies.”

According to the Ministry of Finance, Iraq’s federal budget collected more than 82.377 trillion dinars ($62.9 billion) from January to August 2025. Official data showed that oil revenues reached 73.822 trillion dinars ($56.5 billion), accounting for 90% of total income, while non-oil revenues stood at 8.555 trillion dinars ($6.5 billion). https://www.shafaq.com/en/Economy/PM-Al-Sudani-Iraq-targets-oil-derivatives-exports-by-2030

Gold Prices Climb In Baghdad And Erbil Markets

2026-01-28 Shafaq News– Baghdad/ Erbil Gold prices increased on Wednesday in Baghdad and Erbil, with 21-carat gold selling at more than 1.14 million Iraqi dinars per mithqal, according to a Shafaq News market survey.

In wholesale markets on Baghdad’s Al-Nahr Street, 21-carat gold, including Gulf, Turkish, and European varieties, sold at 1.141 million dinars per mithqal (five grams), with buying prices at 1.137 million dinars, up from 1.105 million dinars on Tuesday.

21-carat Iraqi gold recorded a selling price of 1.111 million dinars per mithqal, while buying prices stood at 1.107 million dinars.

In retail jewelry shops, 21-carat Gulf gold sold for between 1.140 million and 1.150 million dinars per mithqal, while Iraqi gold ranged from 1.110 million to 1.120 million dinars.

In Erbil, 22-carat gold sold at 1.210 million dinars per mithqal, 21-carat gold at 1.155 million dinars, and 18-carat gold at 990,000 dinars.

Gold prices have continued to climb since surpassing the one-million-dinar threshold for the first time in Iraqi local markets on January 21.

Read more: $10K per kilo: The new fee killing Iraq’s gold trade

https://www.shafaq.com/en/Economy/Gold-prices-climb-in-Baghdad-and-Erbil-markets-9-4

Gold Cracks $5,200 Milestone Following 20% Annual Rally

2026-01-28 Shafaq News Gold broke through $5,200 for the first time on Wednesday, after rising more than 3% on Tuesday, as the dollar plunged to a near four-year low amid persisting geopolitical concerns, ahead of a U.S. Federal Reserve monetary policy decision.

Spot gold jumped 1.1% to $5,243.58 per ounce, as of 0314 GMT, after scaling a record high of $5,247.21 earlier, up more than 20% since the start of the year.

U.S. gold futures for February delivery surged 3.1% to $5,237.70 per ounce.

"(Gold's rise) is due to the very strong indirect correlation with the dollar and yesterday's price-rise in gold in the U.S. session was due to Trump's remark to a casual question about the dollar which implied that (there is) a broad-based consensus within the White House to have a weaker greenback going forward," said Kelvin Wong, a senior market analyst at OANDA.

The U.S. dollar was grappling with a "crisis of confidence" as it struggled near four-year lows, exacerbating dollar selling, after President Donald Trump said the currency's value is "great" when asked whether he thought it had declined too much.

U.S. consumer confidence, meanwhile, slumped to its lowest level in more than 11-1/2 years in January amid mounting anxiety over a sluggish labor market and high prices.

Trump added that he will soon announce his pick to serve as head of the U.S. central bank, and predicted interest rates would decline once the new chair takes over.

The Fed is widely expected to hold rates steady at its January monetary policy meeting, currently underway. FEDWATCH

Wong added that near-term resistance for gold could be seen around $5,240/oz. Deutsche Bank said on Tuesday that gold could climb to $6,000 per ounce in 2026, citing persistent investment demand as central banks and investors increase allocations to non-dollar and tangible assets.

Spot silver was up 1.9% at $115.11 an ounce, after hitting a record high of $117.69 on Monday. The white metal has already jumped almost 60% so far this year.

Spot platinum gained 2% to $2,692.60 per ounce after hitting a record $2,918.80 on Monday, while palladium was up 1.4% at $1,961.68. (Reuters) https://www.shafaq.com/en/Economy/Gold-cracks-5-200-milestone-following-20-annual-rally

Dollar Eases Slightly In Baghdad And Erbil

2026-01-28 Shafaq News– Baghdad/ Erbil The US dollar opened Wednesday’s trading slightly lower in Baghdad and Erbil, declining by about 1,200 Iraqi dinars compared with the previous session.

According to a Shafaq News market survey, the dollar traded in Baghdad’s Al-Kifah and Al-Harithiya exchanges at 153,000 Iraqi dinars per 100 dollars, down from 154,200 dinars recorded on Tuesday.

In the Iraqi capital, exchange shops sold the dollar at 153,500 dinars per 100 dollars, while buying prices stood at 152,500 dinars.

In Erbil, the dollar also declined, with selling prices reaching 154,600 dinars per 100 dollars and buying prices at 154,500 dinars https://www.shafaq.com/en/Economy/Dollar-eases-slightly-in-Baghdad-and-Erbil

Al-Rasheed Bank Continues Dollar Sales To Travelers At Official Rate

Today, 12:34 Baghdad-INA Al-Rasheed Bank announced on Wednesday that it will continue selling US dollars to travelers at the airport and designated bank branches at the official exchange rate.

A statement from the bank, received by the Iraqi News Agency (INA), said, "Al-Rasheed Bank announces the continuation of providing dollar sales services to travelers through branches operating within airports and other designated branches to facilitate citizens' access to the currency."

The bank confirmed that its branches in Baghdad, Najaf and Basra airports continue to operate, including selling dollars to travelers according to currency sales instructions and providing them with cash needs during official holidays, calling on travelers to visit the approved branches inside the airports and the branches designated to ensure receiving dollars directly at the official rate. https://ina.iq/en/economy/45107-al-rasheed-bank-continues-dollar-sales-to-travelers-at-official-rate.html

Basrah Crude Slips Against Global Upward Trend

2026-01-28 Shafaq News– Basrah Iraq’s Basrah crude recorded modest losses on Wednesday, with prices easing by 2.34%, despite a surge in global oil prices.

Basrah Heavy crude fell to $60.16 per barrel, and Basrah Medium crude declined 1.29%, reaching $62.61 per barrel.

Brent crude futures rose 28 cents, or 0.4%, to $67.85 a barrel. US West Texas Intermediate (WTI) crude climbed 35 cents, or 0.6%, to $62.74 a barrel. https://www.shafaq.com/en/Economy/Basrah-crude-slips-against-global-upward-trend

MilitiaMan and Crew: IQD News Update-"Iraq Dinar: Trade & 10-Year Contracts Now"

MilitiaMan and Crew: IQD News Update-"Iraq Dinar: Trade & 10-Year Contracts Now"

1-27-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-"Iraq Dinar: Trade & 10-Year Contracts Now"

1-27-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….1-27-26…..TRUMP CARD

KTFA

Tuesday Night Video

FRANK26….1-27-26…..TRUMP CARD

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Tuesday Night Video

FRANK26….1-27-26…..TRUMP CARD

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

What Frank’s suit color’s mean…. FRANKS SUIT COLORS FOR CC'S..... WHITE = NEW INFO…. SILVER = INTEL FROZEN…. RED= HIGH ALERT… PURPLE=GUEST WITH US…. BLUE = AIR FORCE…. BLACK = GROUND/FF’S…. GREEN= MR OR FAB 4 ... GOLD = CHANGE… ORANGE=IMPLEMENTATION